Despite crypto price volatility or law enforcement activities, the illegal markets of a darknet are still thriving. The criminal activity involving the cryptocurrency is at an all-time-height.

Last year was one of the best for the black crypto markets, shows the recently published 2020 Crypto Crime Report by Chainalysis, a blockchain data analysis company.

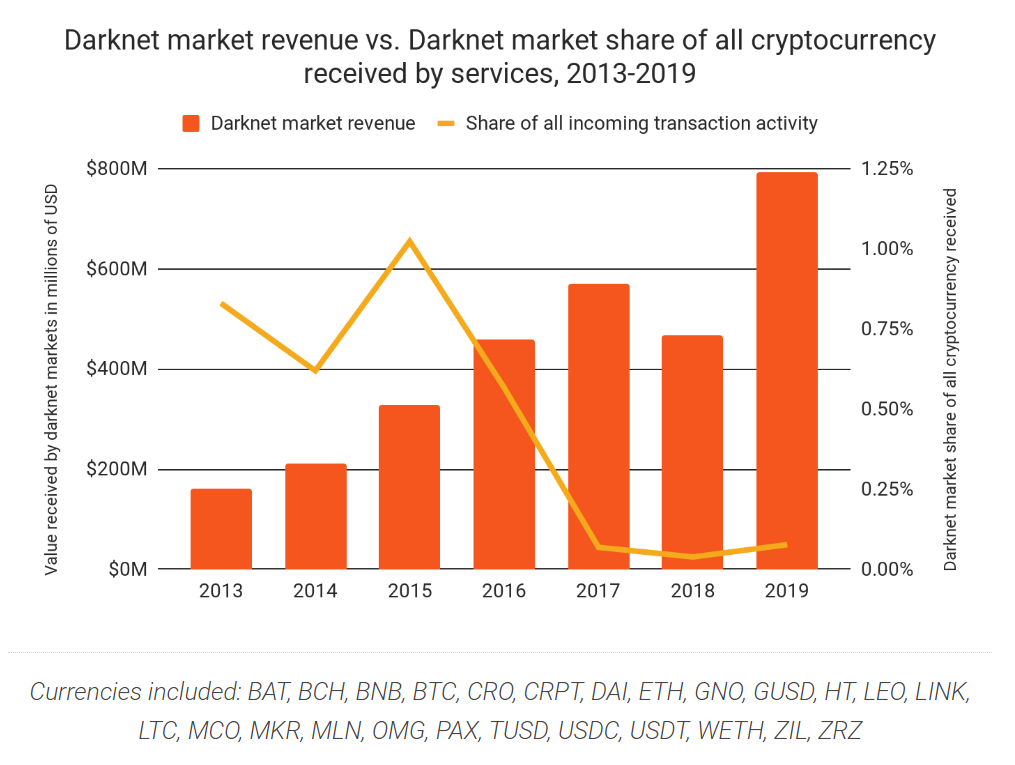

The amount of cryptocurrency spent on darknet markets, where stolen credit card details, drugs, arms, and other illicit stuff can be purchased, increased up to 70% to over $790 million. The share of cryptocurrency flows coming on darknet markets have doubled for the first time in four years, study reports:

For the first time since 2015, darknet markets increased their share of overall incoming cryptocurrency transactions, doubling from 0.04% in 2018 to 0.08% in 2019.

According to the report, scams are the biggest threat as they still are the highest-earning category of crypto crime. The majority of illegal funds come from Ponzi schemes – a fraudulent investing scam, that promises high rates of return with little risk to investors. It is similar to a pyramid scheme, where funds of new investors are used to generate payments for the previous ones.

The study shows a growing number of blackmail scams, where hackers steal or encrypt computer files and refuse to give them back unless a payment is made. “The vast majority of ransomware proceeds are paid in bitcoin,” FBI officer revealed during the RSA Conference 2020 session this February.

Dark web’s most favorite

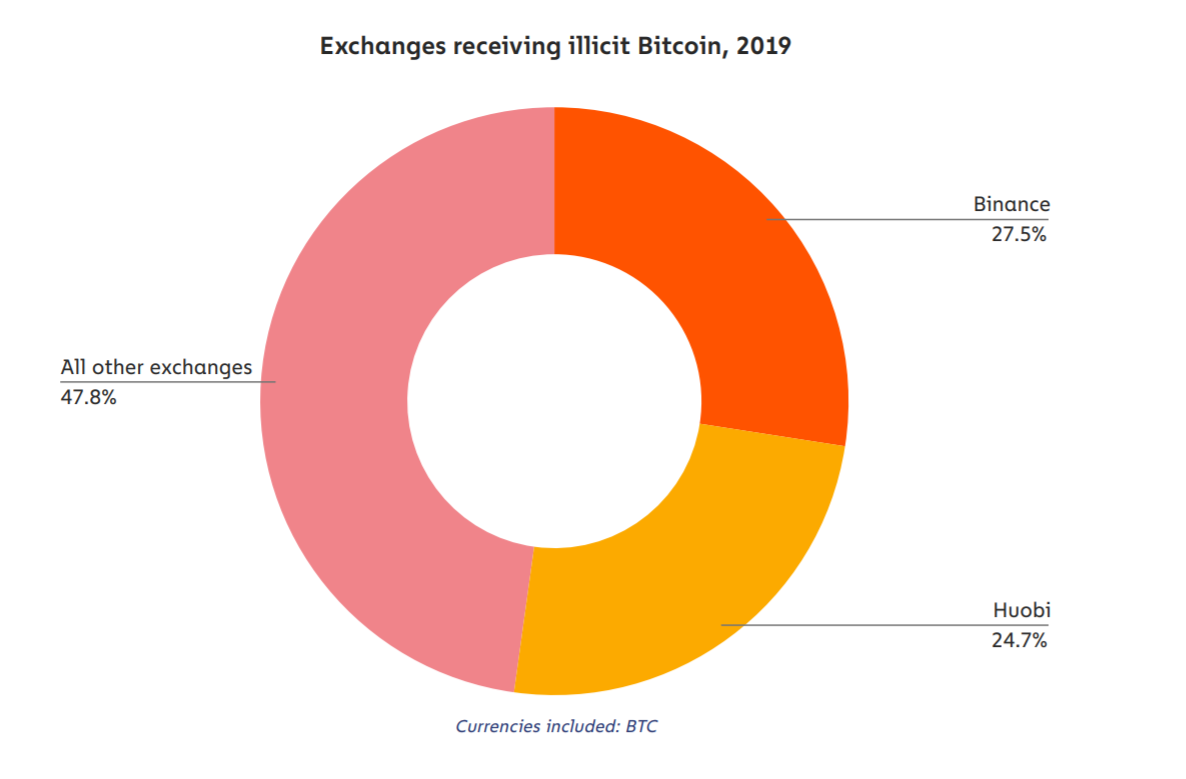

The blockchain surveillance analysis informs, that the biggest part of darknet market transactions still flow through virtual asset exchanges. They are the essential part of the scheme, where customers send crypto to vendors and vendors then send funds to cash out.

As nearly all of the darknet markets accept bitcoin (BTC) for payments, bitcoin remains the most popular virtual currency for purchases within the deep web, the statistic shows.

The study revealed, Ether (ETH) being one of the most popular virtual currencies, used in the Ponzi schemes, where it strongly overtakes other cryptos like Bitcoin or Tether (USDT).

The dominance of bitcoin and ether, however, is followed by the rising role of Bitcoin Cash (BCH). The increase of the Bitcoin Cash, a more scalable and cheaper digital currency, was visible in transactions, connected with the ransomware attacks.

Chainalysis notes that illicit internet markets also tend to accept digital currencies wich focuses on privacy. The cryptocurrency like Monero (XMR), that allows almost total anonymity while hiding all clues, such as digital addresses and value of the transactions.

Other cryptocurrencies detected in the darknet transactions are Litecoin (LTC), Tether (USDT), Basic Attention Token (BAT) and others, but as their amounts are smaller, these coins have no solid influence to the crypto trends of the deep web.

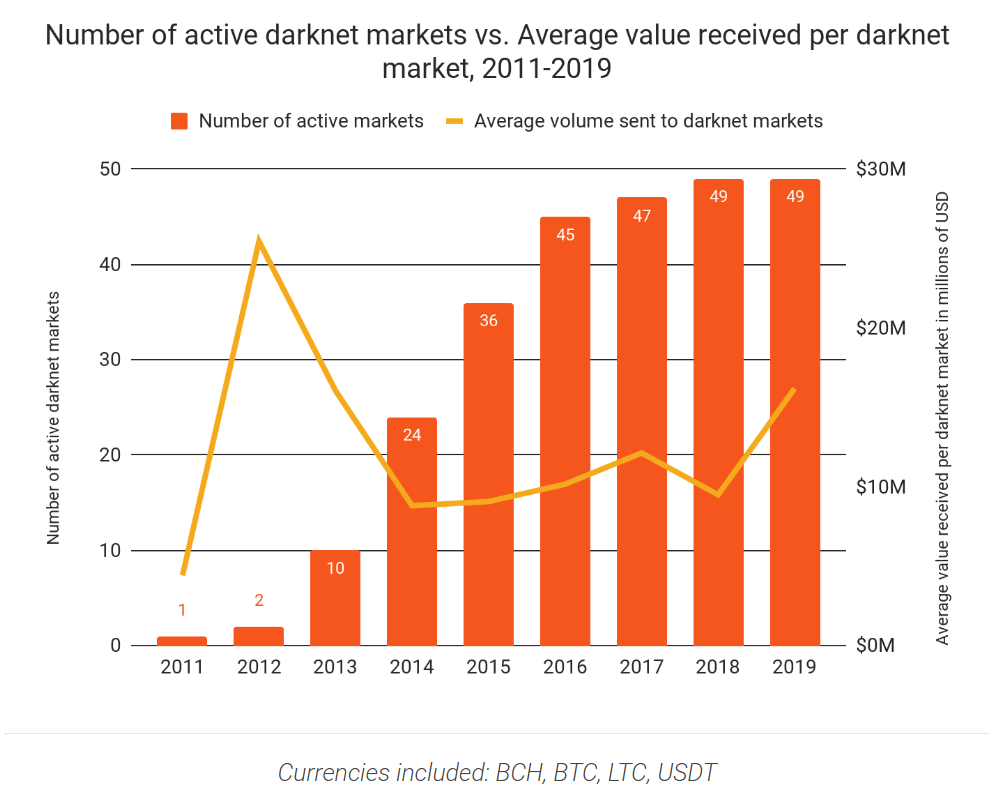

Despite the actions of the law authorities last year, when some biggest illicit online markets were shut down, the new ones filled the vacuum. According to blockchain analytics, there still are nearly 50 shady markets operating around the darknet, some of them adopting a fully decentralized structure, similar to the blockchain itself.