For those of us immersed within the cryptocurrency space, it’s easy to think that mass adoption is near a tipping point. Especially when you consider that Aston Kutcher and Vitalik Buterin’s Stoner Cat NFT animated series sold out in less than 40 minutes, we must be close to widespread acceptance of cryptocurrency, right?

Well, not quite.

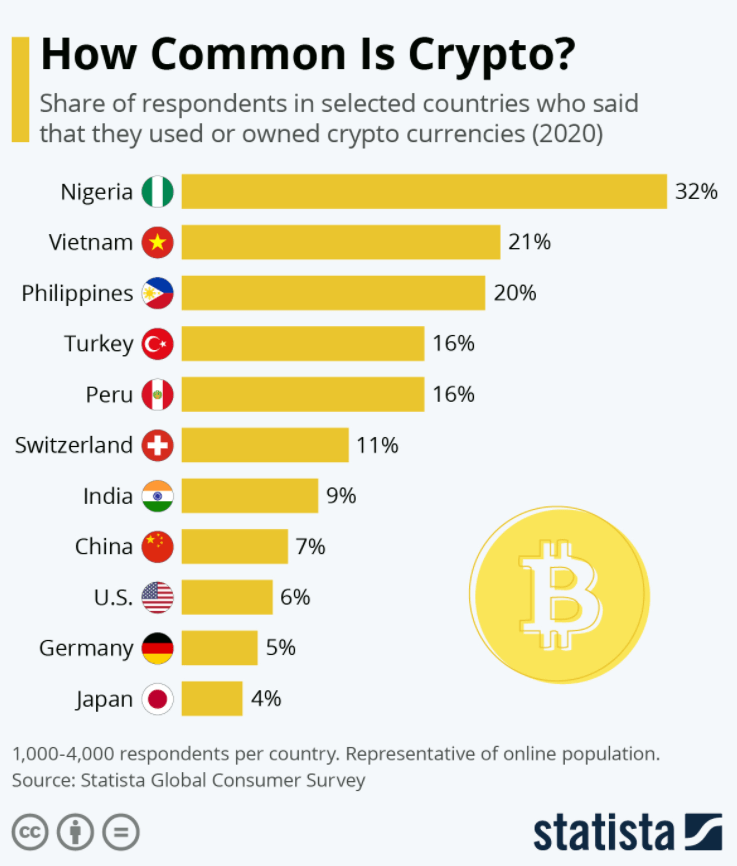

A global consumer survey covering 74 nations conducted by Statista last year, found that in the top 11 countries, an average of only 13% of individuals own or have used cryptocurrencies.

Sponsored

Here’s the breakdown by country.

Based on this graph, we are still witnessing the early ascendence of crypto.

According to Steve Gregory, CEO, U.S. region, Currency.com the main reason for this lagging acceptance for digital assets is the fear, uncertainty, and doubt – better known as FUD – that seems to dominate mainstream media coverage of cryptocurrencies.

Sponsored

In his exclusive interview given to DailyCoin’s CEO Martynas Kasiulis, he says:

“There is definitely a slight distrust in mainstream media for cryptocurrency. I think that’s largely predicated on journalism being a lot of clickbait, which contributes to the problem. I think that people hear headlines about a scam and think there are probably more scams than the ones they hear about. I’ve been in the industry a long time now, and I would say that’s a very small portion of the industry.”

He goes on to explain that Currency.com is different than other exchanges because it currently offers a wide range of investments spanning cryptocurrencies, government bonds, major stock indices, securities, foreign exchange pairs, and commodities.

There are more than 1,700 tokenized assets to choose from right now on Currency.com with plans to offer up to 10,000.

Another key difference, according to Gregory, is the information resources available to Currency.com users that include training tutorials, trading charts, and industry news – all on one site.

He went on to say that combining information with interaction will only help accelerate user understanding and subsequent acceptance of cryptocurrencies. He said:

“I think that’s something that’s lacking within this space. Knowledge for the retail public is what’s going to drive adoption more because once they start to get comfortable and understand the benefits of cryptocurrencies they’ll see the value. For someone like me who’s been in crypto for more than five years now, I understand the benefits. I’m fully on board, but it took me a long while to get here, and it took a lot of education. I think if we can provide that to the average person, they’re going see the benefits of this asset class,”

On The Flipside

- There is an unavoidable tradeoff of mass adoption for any technology. Broad acceptance usually requires a baseline level of understanding. To reach that baseline, either the tech has to be distilled to the lowest common denominator or the users must educate themselves – neither option is optimal.

- Even with robust resources such as those offered by Currency.com, it’s difficult to compel individuals to use those educational resources. It’s the old saying, “you can lead a horse to water, but you can’t make them drink.”

- In the Statista chart above, it’s interesting to note that some countries that have vocally opposed cryptocurrency use or its mining – namely Turkey, India, China – seem to have higher adoption than the U.S.