A recent report from DappRadar has revealed that, despite the frequent hacks pervading the cryptocurrency space in October, the market has maintained its growth, recording a total market capitalization that exceeds $1 trillion at the time of writing.

Since October 25th, when the market turned bullish after months of bearish sentiment, the cryptocurrency sector has roared back into action, reclaiming the $1 trillion level in terms of total market cap. Cryptocurrencies across the board, including leaders Bitcoin (BTC) and Ethereum (ETH), have experienced daily gains, with the bears seemingly being put in their place.

In October, blockchain dApps recorded an average of 2.01 million daily unique active wallets (UAW), representing a 6.84% increase from the previous month. The metric demonstrates the market’s continued strength and resilience in the face of a tumultuous global economy.

A Rise in Crypto-Related Hacks

The positive developments come despite the market’s recent security lapses. According to the DEFIYIELD database of DeFi scams, hacks, and exploits, October experienced the largest volume of funds lost since the start of 2022, as the numerous instances of security breaches resulted in the theft of cryptocurrency assets valued at an approximate $1.09 billion.

Sponsored

Cybercriminals appear to favor cross-chain bridges as their targets, with such protocols accounting for 82% of October’s losses. Francisco Valdevino da Silva, commonly known as the “Bitcoin Sheikh,” suffered the largest attack of the month, with the offender stealing and laundering approximately $766 million from thousands of Brazilians, as well as citizens of at least 10 other nations.

NFTs Warming up to Crypto Winter

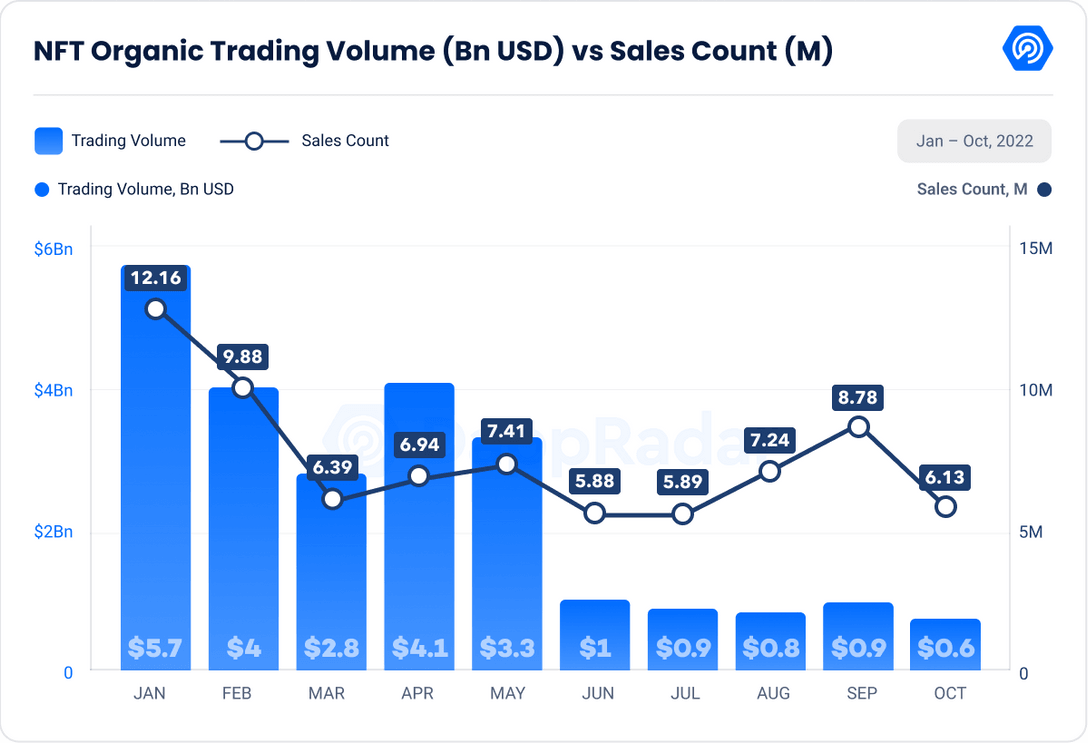

The DappRadar report further noted that, while October saw a clear drop in NFT trading volumes and sales, the number of individual non-fungible tokens (NFT) traders has steadily increased, rising 18%.

NFT trading volume dropped by 30% month-over-month down to $662 million in October, marking a new low for the year. Furthermore, the number of transactions recorded since September declined by 30%. Despite the sectors diminishing overall trade volume, the number of individual traders has spiked by 18% to 1.11 million.

Sponsored

The increase in the number of unique NFT traders can be partly attributed to the influx of newcomers to the crpyto space, which suggests that NFTs are still sought by newbies and experienced traders alike. Later in the report, it was noted that seven Yuga Labs projects experienced an increase in sales volume in October, securing its place as one of the top performing NFT projects overall.

On the Flipside

- The unexpected market recovery did not come without cost, as almost $1.2 billion worth of short positions were liquidated on the first day of the market’s rebound.

Why You Should Care

The protracted crypto bear market appears to have met its end in October, as the market surged back above the $1 trillion mark by market capitalization. Hope seems to be be reigniting among investors, even despite 2022 witnessing the highest value of stolen crypto assets. With large corporations such as Visa, PayPal, and Western Union applying for trademarks in an effort to increase their crypto presence, DappRadar forecasts that the market will continue its bull run, which could even prove to be more intense than past rallies.

Read more about some of October’s biggest DeFi hacks:

DeFi Hack Season Continues as TempleDAO (TEMPLE) and Mango Markets (MNGO) Lose over $100M

Read more about how different generations view crypto:

A Substantial Portion of Gen Z and Millennials Prefers Investing in Bitcoin and Crypto: Study