Fears of insolvency have been high around the Celsius Network, as “extreme market conditions” forced the project to pause withdrawals three weeks ago. However, with July rolling around, Celsius Network has begun aggressively repaying its debts.

Celsius Network Repays $120 Million MakerDAO Debt

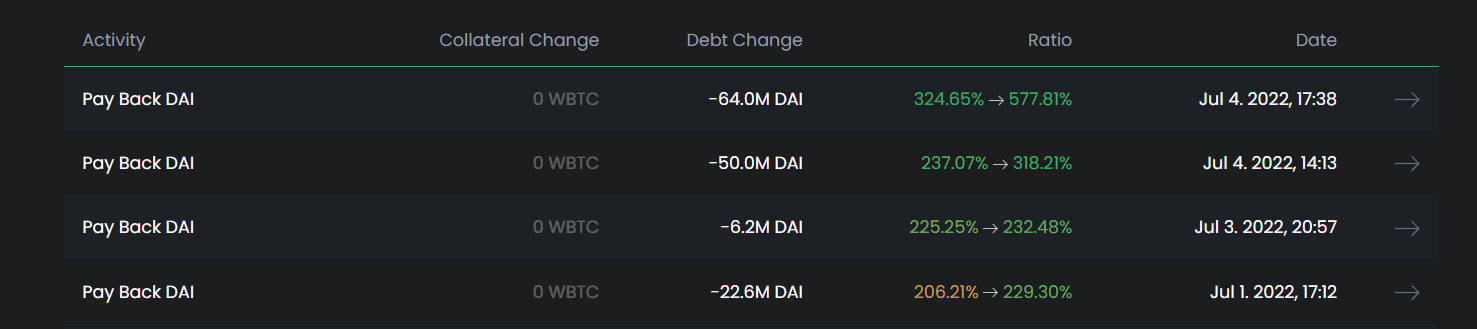

On-chain data shows that since July 1st, the Celsius Network has remunerated $142.8 million of its debt to decentralized lending platform Maker Protocol across four transactions, with $114 million of the repayments being made on July 4th.

At the time, the liquidation price for the loan stood at $10,500. According to DeFi Explore, the aggressive debt repayments made by the Celsius Network has helped reduce to the liquidation price on its WBTC collateral to $4,967.09.

Essentially, by paying down its Maker debt, Celsius has de-risked its loan position from potential liquidation.

Celsius Network Repays Aave and Compound Debts

Not only has Celsius kicked off the month by repaying its MakerDAO debts, but crypto researcher Plan C reported that the crypto lender also paid off its debts to Aave and Compound on July 2nd, which had amounted to a cumulative $67 million.

On the Flipside

- Vauld, a crypto lending platform backed by Coinbase, has become the latest casualty of the crypto crash.

- Vauld has suspended all withdrawals, trades, and deposits on its platform as it faces down a liquidation crisis.

Why You Should Care

The aggressive repayment of debts has caused a flurry of excitement among the platform’s users, with many believing the Celsius Network’s insolvency scare to be over.

Find out more about the suspension of withdrawals in:

Sponsored

Celsius Crypto Exchange Pauses All User Activity, Sends $320M to FTX

For more on the ripple effect of the pause, read: