Since the crypto winter of 2018, Bitcoin closed January 2022 as its start to a worst year, with the world’s leading crypto recording a loss of 18%, falling to a six-month low in the process. The price drop saw Bitcoin’s dominance hit its lowest point since May 2018.

Despite this, the final week of January brought a sigh of relief for Bitcoin investors as the crypto rallied from $33.5k to rise above the $38k mark. In addition to its price recovery, Bitcoin’s dominance of the crypto market cap has only increased.

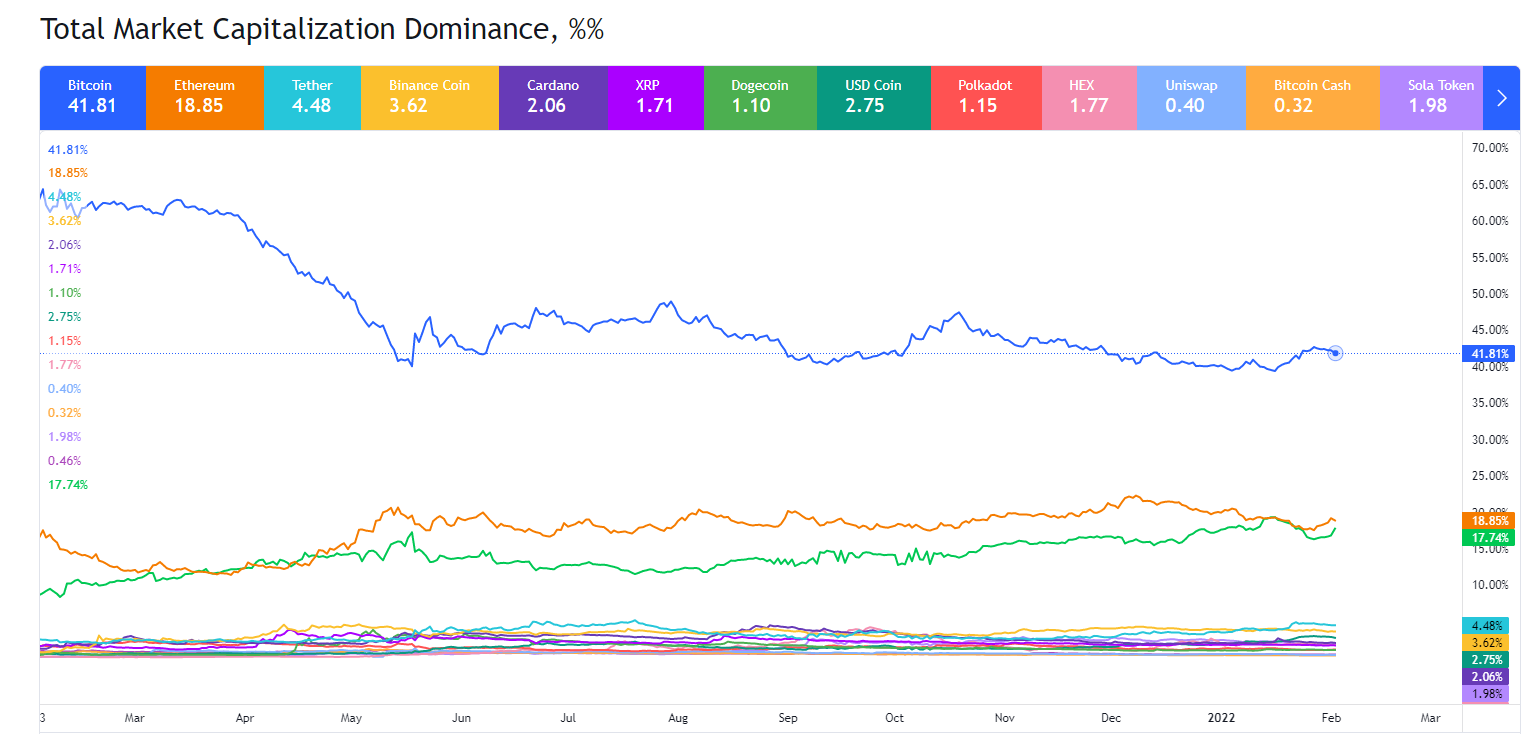

Bitcoin Dominance at Highest Point Since November

Following the rally at the end of January, the dominance of Bitcoin hit 42.93%, levels which were last recorded in November. Bitcoin’s dominance now stands at 41.8% as of this writing.

Sponsored

As Bitcoin’s dominance recovers, there has been no indication of an Altcoin rally to challenge the world’s leading cryptocurrency, which now contributes $770 billion to the industry’s $1.77 trillion global market cap.

The total market cap dominance of the crypto market. Source: Tradingview

Meanwhile, leading Altcoins have been on the back foot for some time. While Bitcoin’s January losses totaled 18%, over the same period, Solana, Ethereum, and Polkadot lost 47%, 34%, and 41%, respectively.

Sponsored

In addition to this, on-chain analytics firm Messari reports that the realized cap of Bitcoin has remained constant since BTC’s $69k all-time highs in November, currently sitting at $453 billion.

Bitcoin Steadies the Ship Above $38K

Coming back from its January drought, Bitcoin rallied to hit $39.1K for the first time since January 21st. Following its 5% price boost as it entered February, Bitcoin has steadied the ship at above $38k, now trading at $38,687 as of this writing.

The seven day price chart for Bitcoin (BTC). Source: Tradingview

On the Flipside

- Despite Bitcoin’s recent price recovery, options traders have turned bearish and remain hesitant on betting on Bitcoin’s next movements.

Why You Should Care

The tables appear to have turned in Bitcoin’s favor, which had seen predictions that it would lose more of its dominance to its biggest rival, Ethereum.