- The crypto market regained ground that was lost during the bear market.

- Bitcoin was able to pay a brief visit above $24,000 before consolidating.

- Altcoins rallied following positive Fed interest rate changes

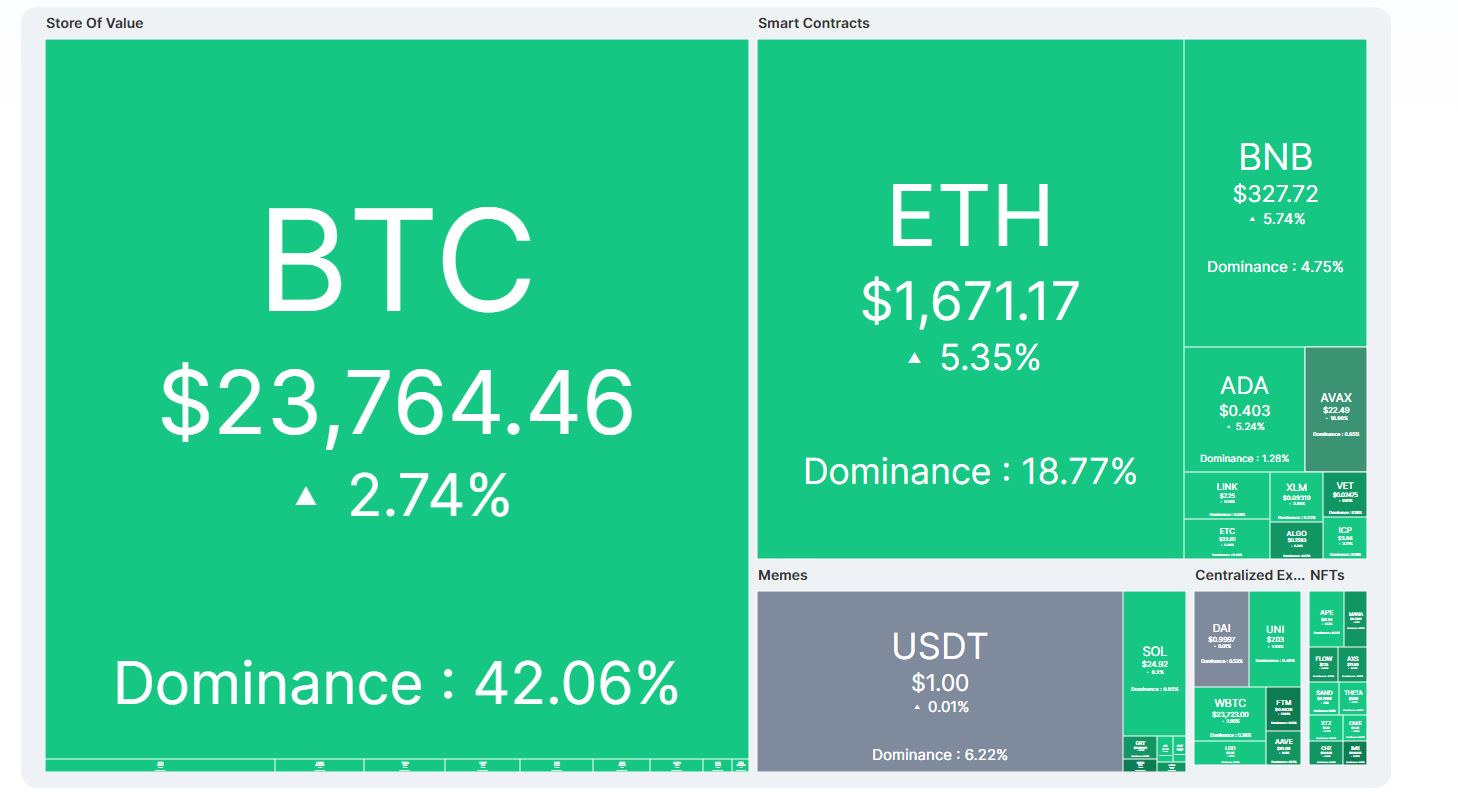

The cryptocurrency market opened in February on a positive note, with cryptocurrencies demonstrating bullish trends on February 2nd. Bitcoin’s price has risen above $23,500 and is looking to take out and hold the $24,000 level following a 3% surge over the last 24 hours.

Altcoin Gainers

Ethereum has also gained 5.52% over the same period, trading at $1,655 at the time of writing, leading the Altcoin rally. Of the other cryptocurrencies ranking in the top 10 by market cap, Polygon, Doge, Cardano, BNB, and Ripple, recorded notable gains.

Some coins shone more than others in the sea of green, with Avalanche and Polygon rising 14% and 11%, respectively. As Bitcoin’s price rose, Aptos, Gala, Threshold, Decentraland, and Solana claimed double-digit gains.

February 2nd 2023 Crypto Heatmap, Source: CoinMarketCap

The price movement in the cryptocurrency market was influenced by several factors, with the U.S. Federal Reserve’s expected rate hikes and dovish remarks made by Chairman Jerome Powell among them. Another significant factor was a short squeeze in the cryptocurrency market outside the Federal Open Market Committee meeting.

In light of the rally, the overall value of the global cryptocurrency market now stands at $1.09 trillion, having risen 4% over the past 24 hours. This change reflects the total volume traded, which increased by 32% to $61.61 billion. Though the crypto market initially responded negatively to the statement from the Fed Chair, bullish sentiment quickly took the reigns after the U.S. Federal Reserve announced an interest rate hike of 0.25%.

On the Flipside

- Despite the bullish trend in the cryptocurrency market, not all coins performed well.

- During the FOMC meeting, the Fed Chair claimed that inflation remains high and the job is not done, suggesting that the interest rate hikes will continue.

- The surge in trading volume is not necessarily an indication of long-term market stability but rather that the short term will be volatile.

Why You Should Care

Understanding the factors driving market trends and the potential impact of economic and regulatory events is crucial for informed decision-making in the crypto market.

For news on the Bitcoin market:

Bitcoin Surges After Fed Relaxes on Interest Rate Hikes

For recent Altcoin news:

Terra Luna’s Stablecoin (USTC) Soars 14% After Binance Removes Warning Label