- FTX bankruptcy documents have been released. Amazon and a Bahamas bar are among the creditors

- Bankruptcy filings show that Alameda Research did not pay many of their bills

In another day of contagion for FTX and Alameda Research, certain bankruptcy documents have been released.

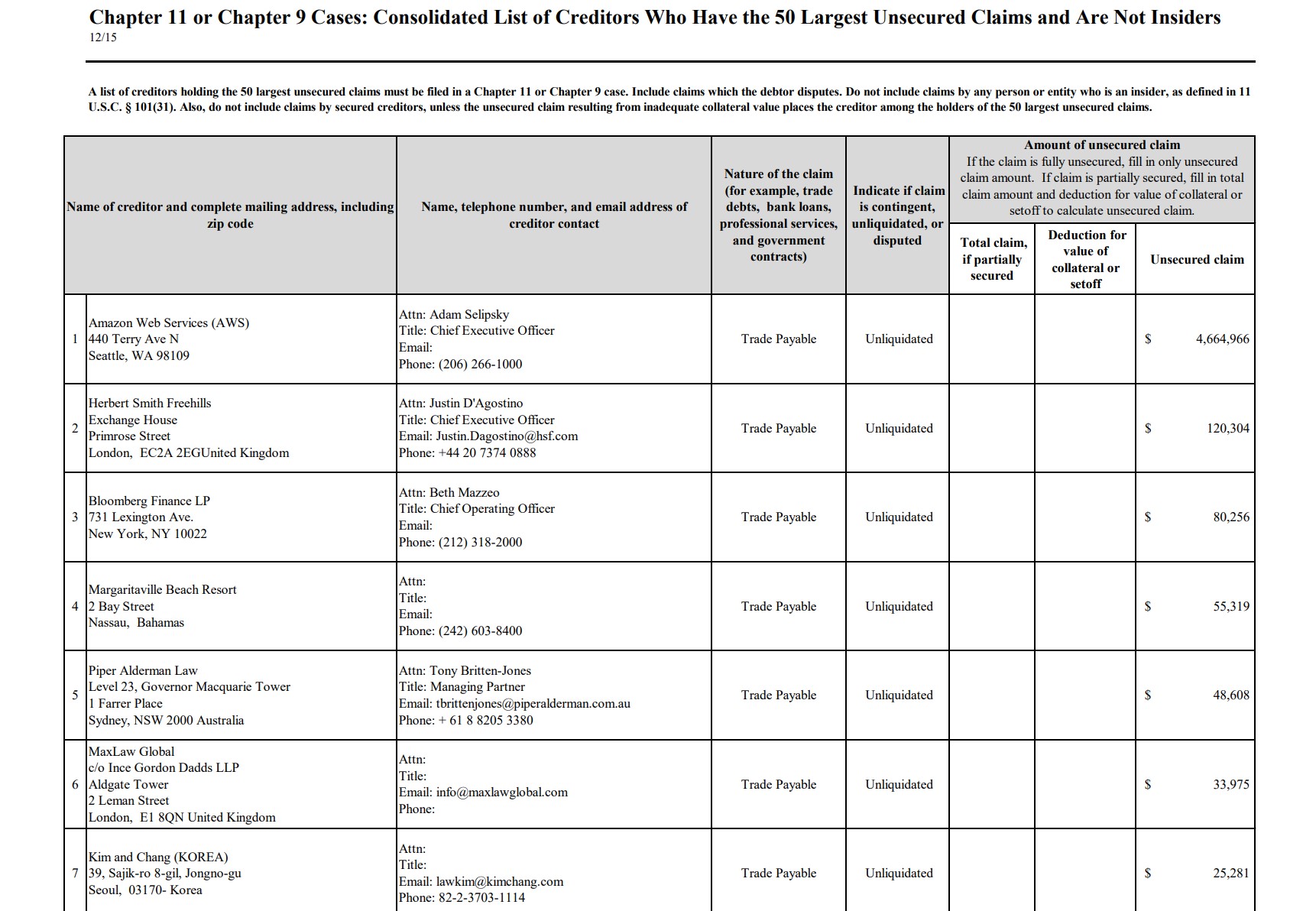

The list of ‘Creditors Who Have the 50 Largest Unsecured Claims and Are Not Insiders’ is mainly made up of law firms and unsettled payments. However, the top payable claim is for Amazon Web Services (AWS) totaling $4,664,966.

The list of top creditors who are not insiders. Source: Kroll

Even for large corporations, this is a large AWS bill. Some community members believe this is due to the intense machine learning environments that Alameda may have deployed.

$4.6 million for AWS… is that normal? What do you get for that?

— Dean Kilton (@deankilton) November 28, 2022

Though it is likely that Alameda was running resource-heavy machine learning environments with AWS, this is more an example of Alameda not paying their bills. By comparison, Facebook spends $11m per month on AWS.

The evidence stacks up as the list of payables continues. Even Bahamas bar Margaritaville Beach Resort is owed $55,319. Their online menu features no prices, but a two-night stay currently costs $357.

Sponsored

Company costs can add up, but it’s hard to deny that Alameda Research was reckless with its spending.

One of the few actually expected outgoings is for Bloomberg Finance LP, totaling $80,256. Bloomberg sells industry-grade terminals that help financial firms analyse data in real-time, the $80,256 could equate to just four licences.

The rest of the currently visible payables totals $253,605 and is solely made up of lawyer fees from around the world.

On the Flipside

- The contagion continues. BlockFi files for bankruptcy whilst legal action ramps up around the FTX controversy.

- How is the market reacting? Blockchain analysis shows a surge in retail holders of Bitcoin and a decrease in ‘large’ holders.

Why You Should Care

As more updates are released regarding the financial situation of FTX and Alameda Research, the lines become blurry. Creditors and payables are important to the ongoing case, as only some of them may be reimbursed. Depending on the size of the reimbursement, this could positively affect the cryptocurrency market.

What the Bahamas have to say about FTX:

Criminal Investigation into FTX is underway: Bahamas Attorney General

The community is still searching for answers:

Crypto Influencers Flock to Bahamas to Find Sam Bankman-Fried