Aave, the noncustodial DeFi lending protocol, became the second decentralized finance protocol with more than $1 billion in total value locked.

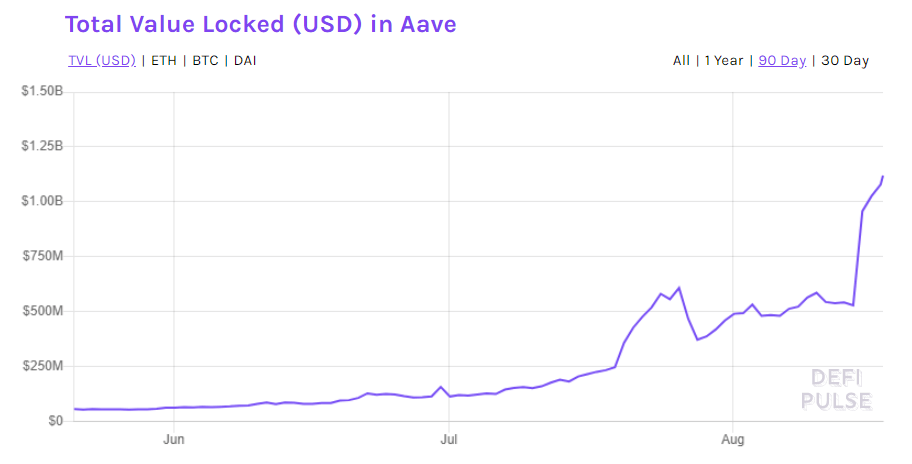

The protocol hit the mark of its first billion on Sunday, August 16 after an impressive growth this weekend. The total value locked in Aave’s lending and borrowing protocol doubled in 48 hours, marking the solid growth from $529.5 million on Friday to $1.02 billion at the same time on Sunday. The total value locked is over $1.12 billion at the time of publishing, according to DefiPulse.

With the current record, Aave becomes the second biggest decentralized finance (DeFi) lending protocol by total value locked. The first one – MakerDAO – hit the milestone less than a month ago, and currently possesses over $1.45 billion locked.

Sponsored

Despite the impressive rally this weekend, Aave is still the third biggest DeFi protocol by market capitalization, currently accounting $703 million, according to CoinGecko. Meanwhile, Chainlink decentralized oracles network tops the leading position with $1.34 billion, and Synthetix derivatives platform is the second biggest DeFi protocol with $776 million market capitalization.

The protocol update

There is the explanation, however, behind the impressive bull run this weekend. One of the oldest DeFi protocols announced the upcoming Aave V2, the protocol upgrade on August 14.

1/ Today we are excited to introduce the Aave Protocol v2, the new Money Market Protocol ready to push DeFi even further ! 👀👀👀https://t.co/yUHE1ShA2g

— Aave (@AaveAave) August 14, 2020

According to Aave’s announcement, the decentralized lending protocol will be implementing numbers of protocol upgrades, including native token functionalities like debt, collateral and margin trading as well as a partnership with the real estate tokenization firm RealT in order to bring tokenized real estate mortgages on Ethereum network.

Additionally, the protocol upgrade will include gas optimization as extremely high gas prices became the problem for the wider adoption of the Ethereum-based protocol. As stated in the announcement, Aave V2 also implements native GasToken Support to reduce users’ transaction costs.

The protocol announced the launch of its governance testnet last week. The transition to a fully autonomous network means the ownership of the protocol will be transferred to the platform’s native LEND token holders, who will be able to vote on Aave Improvement Proposals (API).

Sponsored

The weekend’s rally on Aave brought the whole decentralized finance sector to the new highs of $6.28 billion of the total value locked. This marks another billion poured into DeFi within 48 hours.

The whole DeFi industry is peaking since the end of June when it surpassed the first $1 billion mark of total value locked. However, since then the charts have exploded depicting the skyrocketing growth of over $5 billion in less than two months.