As crypto continues on the path towards going mainstream, with the pace of adoption building worldwide, crypto-related scams have kept pace. With regulations still being vague at best, crypto transfers being irreversable, and most importantly, despite the fact that everyone has heard the buzzwords a hundred times by now, the majority of people being unfamiliar with how crypto works, vulnerability to scammers is perhaps higher than ever.

The reported losses to crypto-related scams in 2021 were nearly sixty times those in 2018, as more than 46,000 people reported losses to a cumulative $1 billion in crypto, according to the Federal Trade Commission (FTC) in the U.S.

Social Media’s Role in Fraud

According to the FTC, social media is the primary originator of crypto-related scams. Nearly half of the consumers that reported cryptocurrency-related fraud in 2021 claimed that it started with an ad, post, or message they had seen on social media.

Sponsored

FTC reports reveal that Instagram (32%), Facebook (26%), WhatsApp (9%), and Telegram (7%) were the top platforms used for crypto scams. Meanwhile, the most common cryptocurrencies people were defrauded of were Bitcoin (70%), Tether (10%), and Ether (9%).

The FTC identified that investors aged 20–49 were more than three times as likely as older age groups to lose cryptocurrency to scammers. 35% of the fraud reported by people in their 30s were related to cryptocurrencies. The amount of crypto lost rises in correlation with age groups, with 18 and 19-year-olds reporting average losses of $1,000, while losses of the same category reached up to $11,708 among older age groups.

The Most Popular Scam Schemes

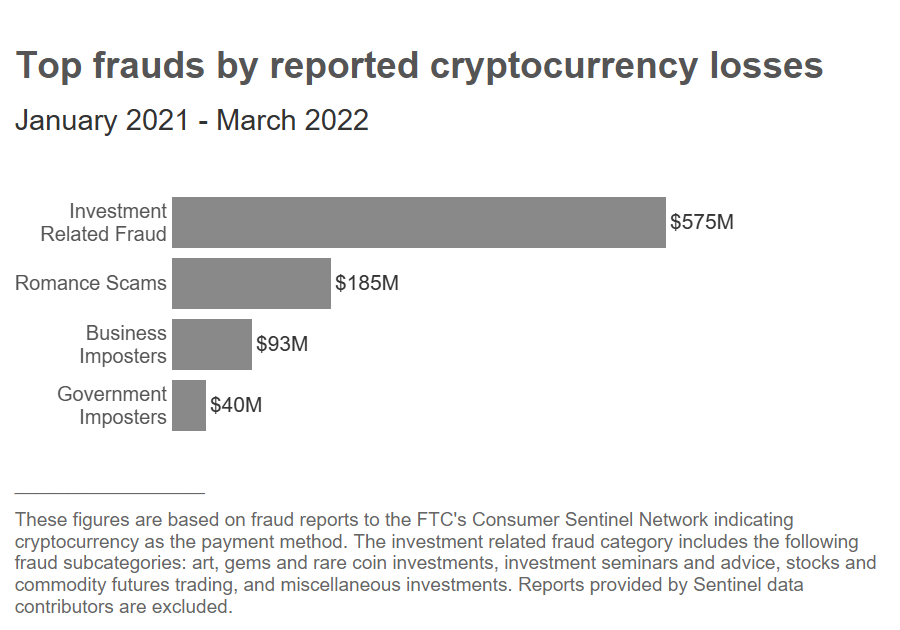

Based on fraud reports made to the FTC, the agency was able to identify repeat scam schemes related to crypto. The most common type of crypto scam reported was Investment Related Fraud, which comprised $575 million of the total $1-billion figure.

“The stories people share about these scams describe a perfect storm: false promises of easy money paired with people’s limited crypto understanding and experience. Investment scammers claim they can quickly and easily get huge returns for investors. But those crypto “investments” go straight to a scammer’s wallet,” underlined the FTC.

In this scheme, investors are convinced to invest using a particular fake investment website or app. These apps typically mislead clients by allowing them to “track” the growth of their crypto. Then, when a client tries to cash out their investment, they’re informed that they must first send more crypto to cover bogus fees, at which point they receive no returns.

Other notorious methods used were romance-related scams, accounting for $185 million in reported cryptocurrency losses in 2021. In these scams, fraudsters use a fake identity to building a “relationship” with the victim, often romantically through a dating app, before convincing them to invest in crypto, either via a duplicated false version of a legitimate website, or by transferring funds directly into a scammer’s wallet address. The median individual reported crypto losses of an astounding $10,000 to such romance schemes.

“These keyboard Casanovas reportedly dazzle people with their supposed wealth and sophistication. Before long, they casually offer tips on getting started with crypto investing and help with making investments. People who take them up on the offer report that what they got was a tutorial on sending crypto to a scammer,” wrote the FTC.

Business and government impersonation scams made up a significant chunk of the losses, with $133 million in crypto reportedly defrauded since 2021. Scammers present themselves as official bank representatives, claiming that the victim’s fiat money is at risk due to an investigation by law enforcement. They then offer to secure the user’s money by putting it into crypto, and are thus tricked into sending money to a scammer’s wallet address.

“These scammers tell people the only way to protect their money is to put it in crypto: people report that these “agents” direct them to take out cash and feed it into a crypto ATM. The “agent” then sends a QR code and says to hold it up to the ATM camera. But that QR code is embedded with the scammer’s wallet address. Once the machine scans it, their cash is gone,” the FTC explained.

The FTC also listed scams involving investment into fake art, gems and rare coins, bogus investment seminars and advice, and other miscellaneous investment scams among those commonly used by bad actors.