For today’s pick, we have chosen NEO as our coin to provide you with a detailed analysis of whether the market will decide to move either to the upside or the downside.

This time, we have used a monthly time frame for market overview and a daily time frame to find the perfect price for execution. It might take a few days to see changes in NEO’s price based on our analysis since we are using the daily time frame as our main one.

Market Overview

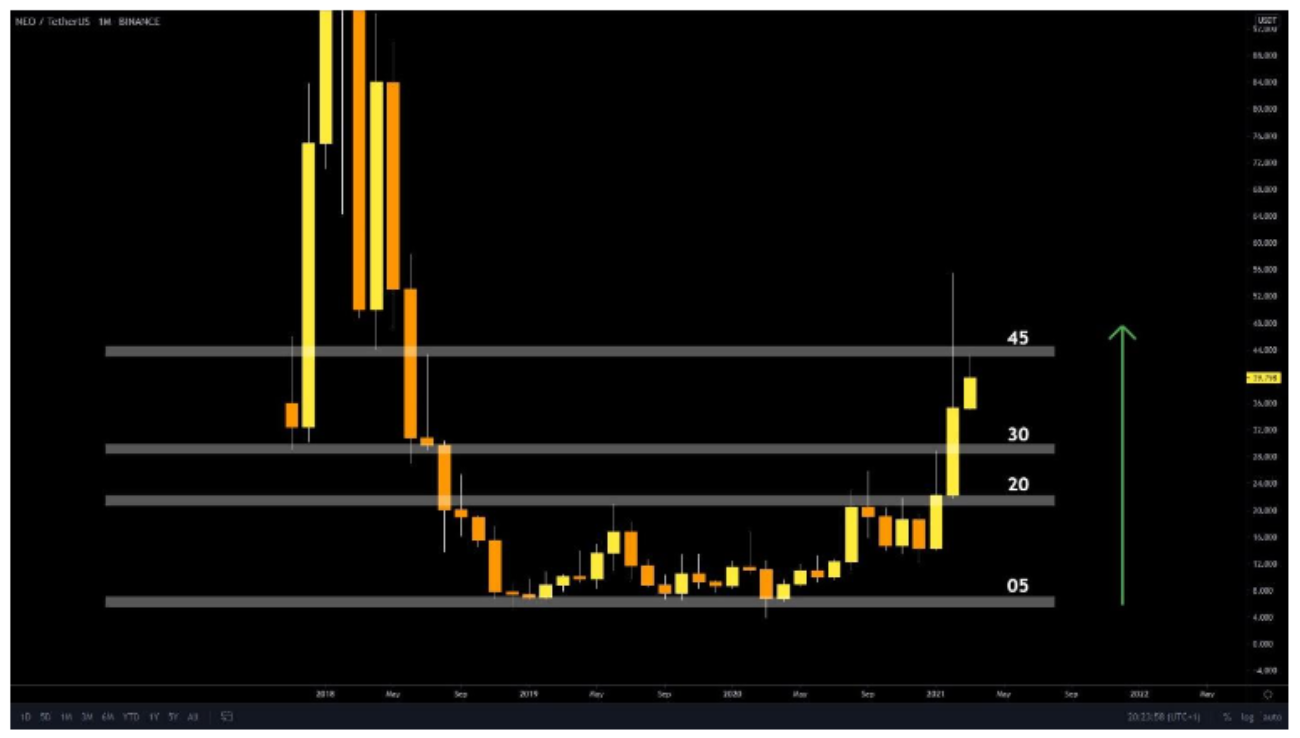

As you can see from the graph, we have segregated the price on a monthly time frame using key levels. You might ask what are “key levels”? Key levels are another term for “support and resistance.”

From the beginning of December 2018 until January 2021, the price was trading inside a parallel channel where the 5 and 20 USDT levels were playing the role of the monthly support and resistance levels, respectively.

In February 2021, the price successfully broke this channel formation to the upside by leaving a huge bullish candlestick where the price reached the 55 USDT level.

After this move, the coin became stuck and faced a strong resistance by the previous swing low around the 45 USDT mark. This caused massive sell pressure and kept the market below the 45 USDT resistance.

Sponsored

Now, let’s move to a lower time frame to have a better understanding of what might happen to the

price of NEO coin.

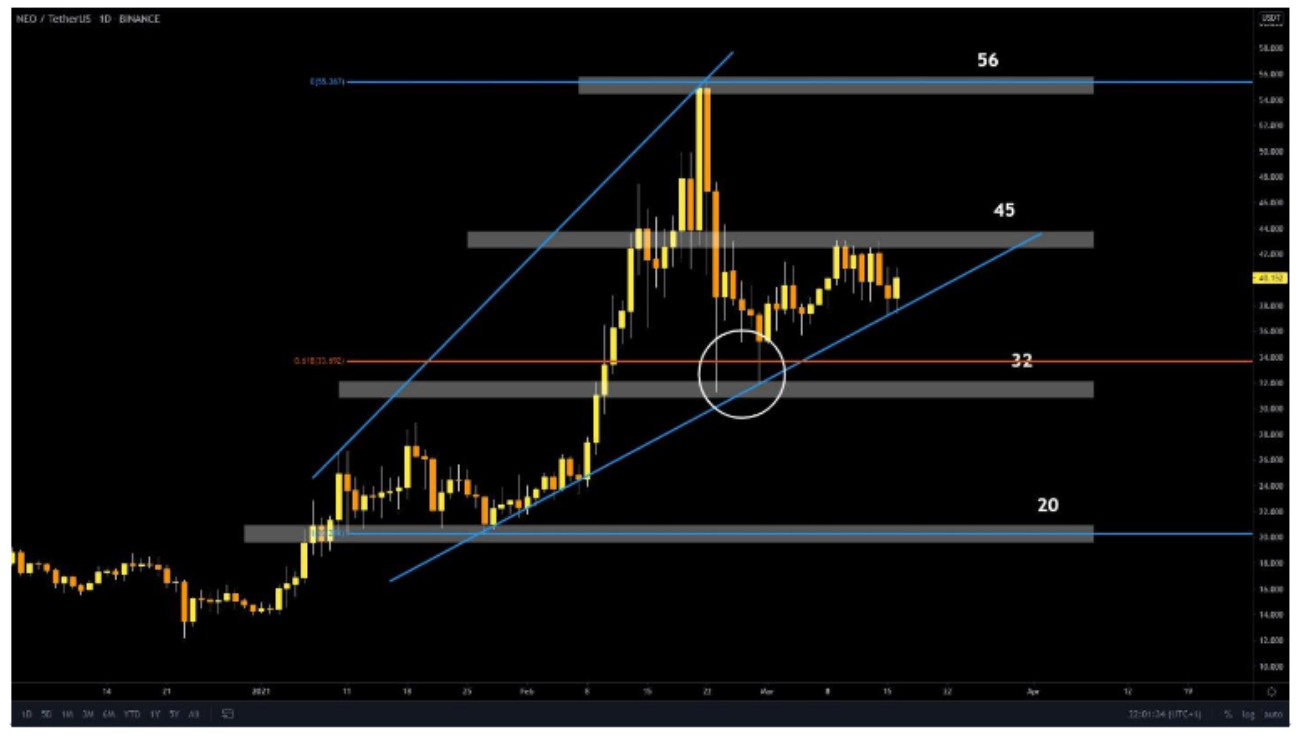

Long Scenario

We will start by looking at the first scenario, which is the buy long Neo coin. The price is trading within an ending expanding diagonal where the price found buyers around the 61.8% Fibonacci retracement level at 32 USDT price. This led to a move upward, and the price tested the 45 USDT mark. A lower

correction has been posted to the trendline support, which could cause a move upward again and break the 45 USDT resistance level. If this occurs, we must wait for a re-test of the new support at the 45 USDT mark (the previous resistance), and then, based on the price action above this level, we should consider a buy position.

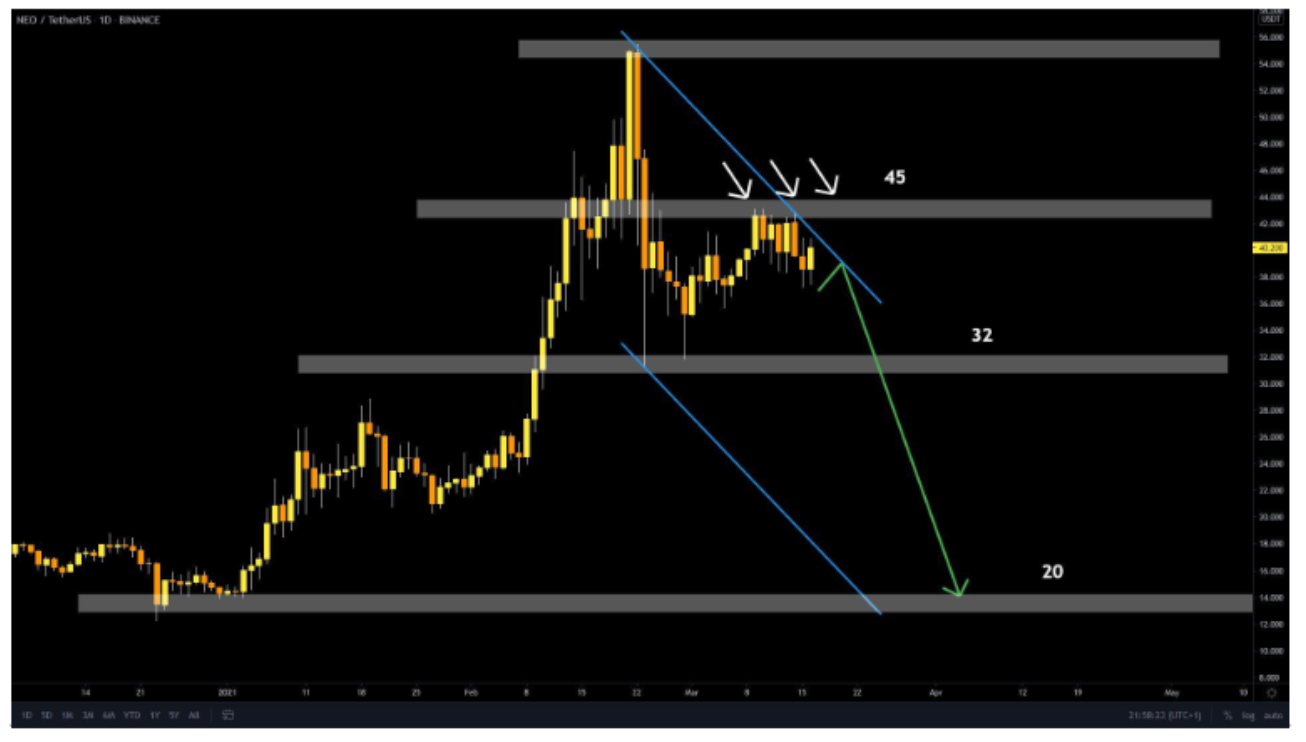

Short Scenario

If the price fails to break the 45 USDT resistance, the long scenario will be invalid and then we should consider short selling NEO coin. As we can see from the following screenshot, the price is forming a possible bearish channel, where there is a high sell pressure around the 45 USDT mark, represented by

bearish candlesticks with big orange bodies. If our analysis is correct and the price starts to move lower, the next target for NEO coin will be the 32 USDT level. Furthermore, if the sellers were strong enough, the 32 USDT support could be broken, and the price of NEO might reach the 20 USDT level, which is located at the lower end of this bearish channel.

Indicators Used for Our Analysis

We have used the most common patterns for this analysis, which are the expanded flat and the bearish channel formation. We combined these patterns with the price action and the market structure to come up with scenarios showing how the NEO coin is likely to move.

Please trade safely.