Investing in cryptocurrencies is not for everyone.

For those of us who’ve been in the crypto-space for more than a year or two, we’re fine with the volatility. We’re fine with the fear, uncertainty, and doubt (FUD) posing as news. We’re fine with whales manipulating the market. And we’re fine with old-guard investors such as Jamie Dimon and Warren Buffet calling cryptos a bubble and “rat poison squared.”

Let’s be honest, not everyone can stomach intraday price swings of 20% or more happening every 3-6 months or so. Again, Investing in crypto is not for everyone.

Sponsored

However, there are alternative investments in the form of stocks that are aligned with blockchain and cryptos that are worth considering. Owners of stocks, are owners of a portion of the company issuing the respective security. That’s quite different from buying a coin or token, which is basically an open-source, yet secure, software investment. For a company to sell stocks, it has to go through a rigorous process leading up to its initial public offering (IPO) and then it must adhere to Security and Exchange Commission regulations to stay listed on a public stock exchange.

We’ll look at four stocks based on a snapshot of their stock performance metrics following their most recent market close, with their price chart opened to the max view from when they began trading.

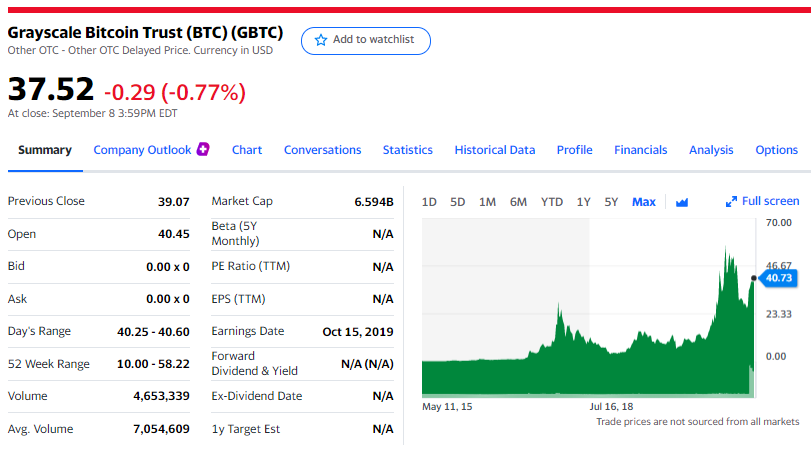

Grayscale Bitcoin Trust

Grayscale is the world’s largest digital currency asset manager with more than $43 billion in assets under management. It’s a subsidiary of the Digital Currency Group and currently offers five different stock trusts for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ethereum Classic respectively. Looking at the Grayscale Bitcoin Trust Fund, which has been around since May 2015, it has a market cap of nearly $6.6 billion and has a 12-month trading range of $10.00-$58.22 per share.

Sponsored

How these trusts work is that a group of initial wealthy investors pool funds to buy a large block of the cryptocurrency named in the trust. Then Grayscale lists the trust on an exchange and sells bits of ownership in the trust in the form of stocks. The actual stock price rises and falls on the value of the underlying crypto AND the trading activity of the stock itself. It’s less volatile than owning the crypto directly and easier to purchase – no digital wallet is needed.

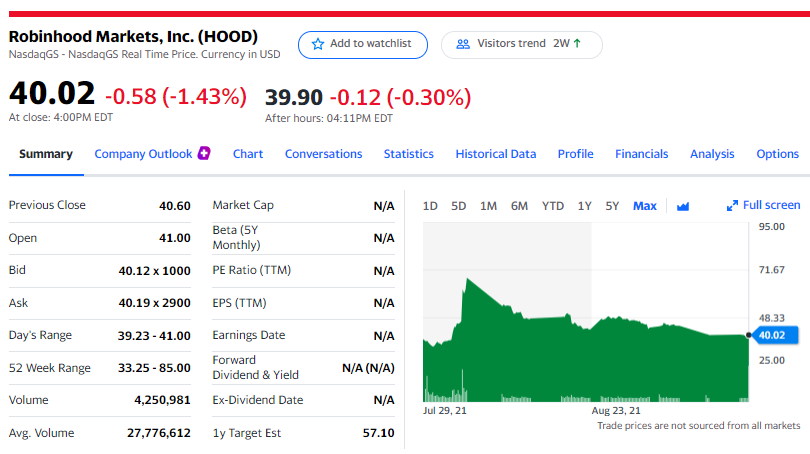

Robinhood

Robinhood went public in June 2021. Since it’s so new it doesn’t have enough data to publish market cap, price-to-earnings ratios, or earnings per share. It’s 12-month trading range is $33.25-$85.00 per share. Robinhood is a wildly popular exchange app for securities and cryptocurrencies. It has no fees and is easy to purchase via any online stock trading service. The biggest issue facing this stock right now is that SEC Chair, Gary Gensler, wants to torpedo its main source of income by eliminating payment for order flow. That’s how Robinhood makes the majority of its revenue, any potential investors need to keep that in mind. You might want to wait until that issue is settled one way or the other before investing.

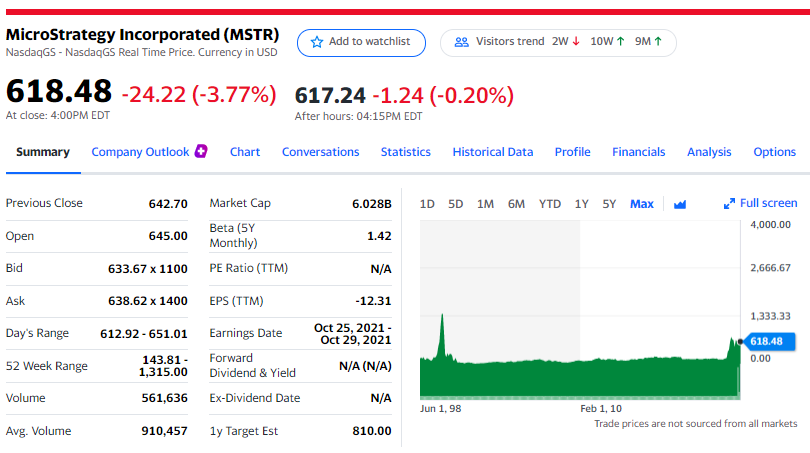

Microstrategy

Of the companies we’re looking at, Microstrategy has been around the longest – more than two decades. It’s an established billion dollar company, with a long list of clients. It focuses on analytics, business intelligence, and technology apps for its business-to-business customers. However, in 2021 it also became a de facto surrogate of Bitcoin. Its CEO, Michael Saylor, has purchased more than 114,000 Bitcoin for $3.16 billion, which has appreciated to $5.3 billion in value.

The company has a market cap of $6 billion and a 12-month trading range of $143.81-$1,315.00 per share. The price seems to have settled north of $600 per share. While it has a lot of Bitcoin on its balance sheet, Microstrategy is diversified in other business services, cloud-based analytics, and technology. It’s also extremely easy to purchase in fractional amounts via any online stock trading platform.

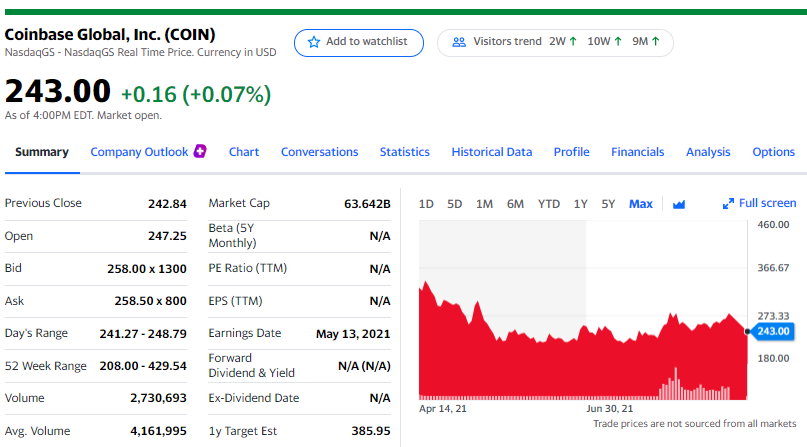

Coinbase

Finally, we have Coinbase. This company is another subsidiary of the Digital Currency Group similar to Grayscale. Coinbase is the largest US-based cryptocurrency exchange in the world. It went public in April of this year. It has a market capitalization of $63.6 billion and a 12-month price range of $208-$429.54 per share. While a significant portion of its revenue currently comes from investors’ transaction fees, it is making a significant investment in building a global blockchain-based infrastructure.

Coinbase leadership believes that it will be able to create a cloud-based blockchain platform that’s analogous to Amazon’s Web Services network. Another advantage of Coinbase is that it currently lists 63 coins and tokens for trading on its platform – adding 22 of those in the second quarter of this year alone. So unlike Grayscale BTC Trust and Microstrategy, your investment in Coinbase is diversified across a broader cross section of the cryptoverse. It’s also extremely easy to purchase shares of this stock.

While not financial advice, the benefits for investing in one of these crypto-aligned stocks is less volatility, enhanced investment diversity, as well as easy access and onboarding. Any of these options are worth considering, whether you’re a no-coin newbie or long-time crypto hodler.

On The Flipside

- All investments have risk. It’s up to you to do your own research.

Why You Should Care?

One word – diversification. Putting all of one’s eggs into one basket is never a good idea. While crypto investors like the action and high returns of digital money trading, only invest what you can afford to lose. Do not borrow on leverage, credit cards, or home equity to buy more cryptocurrencies – that’s not wise. Consistent dollar cost averaging is the best way to mitigate risk and ensure the best investment entry points over time – and that applies to cryptocurrencies as well.