The post-Brexit free trade talks between the UK and EU continue to stall. GBP falls against USD and EUR. Bitcoin struggles to break for another bull run. Should BTC holders get worried about no-deal Brexit?

Negotiations between the European Union (EU) and the United Kingdom (UK) on further trade relations after Brexit ended ineffectively this week. Both sides failed to agree on fishing rights, fair trade rules, and a dispute settlement mechanism.

Although the President of the European Commission (EC) Ursula von der Leyen and the Prime Minister of the UK Boris Johnson decided to try to continue the negotiations until Sunday, there is little optimism about the possible outcome. PM Boris Johnson warned UK citizens to prepare for a no-deal Brexit today.

The UK withdrew from the EU in January and is in a transitional period until the end of 2020. Since then it is still part of the EU’s single market, complies with EU law and contributes to the Community budget. If no agreement will be reached, the no-deal Brexit comes into effect bringing severe economic shortages.

Markets react

The GBP fell the most since September against the US dollar and Euro on Monday after rumors appeared of PM Boris Johnson retreating from free trade negotiations. The pound recovered later this week and even reached the highest point of the year. However, went again through a second fall after the failed agreement on Wednesday.

Sponsored

As the risks of the UK leaving the EU without a trade deal increases, experts predict a severe GBP decline. According to a financial strategist Petr Krpata cited on Bloomberg:

In the case of no deal, we expect a profound GBP collapse -- EUR/GBP above 0.95, possibly briefly touching parity -- due to the fact that this outcome would come as a surprise and investors have not been pricing this in.

Financial Times accordingly reports, the futures market quickly losing numbers of short-selling trades on GBP. “This all gives the currency a long way to fall if the talks fail and leave investors wrongfooted”, says the newspaper.

Sponsored

Gold price shot up by 5% within the first week of December, right amidst the great turbulence in the post Brexit negotiations.

What about Bitcoin?

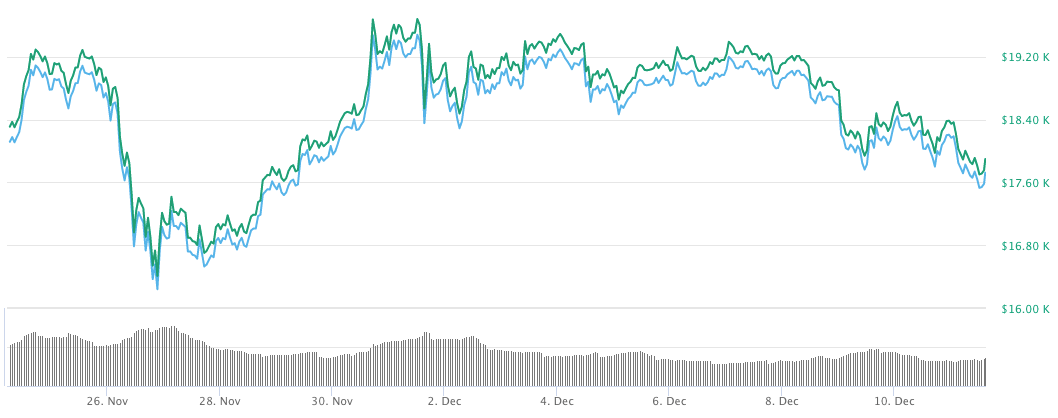

Bitcoin has not shown signs of significant recovery amidst the free trade negotiation turmoil this week. The leading crypto even dropped from $19.741 to $17.922 or over 9% within the specified time. Its price continues to float around $17.800 at the time of publishing.

Potentially Bitcoin can profit from the no-deal Brexit. As recent history shows, Bitcoin wins when fiat currencies are losing their value. Be it the US dollar printing or governments struggling with political and economical crisis. In times of economic uncertainty, investors tend to allocate their funds to safe-haven assets. The ones like traditional or digital gold.

Speaking about gold, JPMorgan predicted this week a significant shift in gold and Bitcoin markets. The global investment giant said “gold will suffer because of Bitcoin” to Bloomberg. According to financial giant, Bitcoin became a popular asset class, its adoption just started and institutional investors already take positions in cryptocurrencies.

The UK too small

Great Britain is the 6th largest economy in the world with a $2.83 trillion GDP and a 66.6 million population. Only around 4% of its adult population – thus about 1.9 million people – own digital currencies. 75% of them hold less than £1.000 ($1.320) in cryptocurrencies and are qualified as a retail investors.

Furthermore, according to Cryptoasset Consumer Research conducted in June 2020 by the UK’s Financial Conduct Authority (FCA) :

The most popular reason for consumers buying cryptocurrencies was as "as a gamble that could make or lose money", acknowledging that prices are volatile.

Although it is yet unclear which part of UK crypto holders has invested in cryptocurrency derivatives, Great Britain’s crypto market is still small compared to the global cryptocurrency market worth over $526 billion at the time of publishing. Following the logic, it could be hard to expect non-deal Brexit to play a significant impact on Bitcoin’s price.