The statistics from various sources indicate – Bitcoin is on the verge of long-term growth.

The latest data from Glassnode reveals – there were almost 2.6 million Bitcoins across digital asset exchanges last week. The Bitcoin amount worth over $31 billion, however, is lower compared to last year (2.8 million BTC).

Despite the fact, the news might look optimistic, as Glassnode suggests the fewer Bitcoins are on exchange, the lower selling pressure appears.

The insight is most probably following the historical data, indicating that investors are moving out from exchanges when they feel confident in particular digital assets. Meanwhile, the flow into the exchanges increases accordingly when the assets become riskier to hold.

Sponsored

In the meantime, Bitcoin continues to test the $12.000 mark, although it dropped slightly under $11.800 at the time of publishing, according to CoinMarketCap. Despite the fact, the world’s largest digital asset outran gold, with whom it has a significantly high positive correlation since the end of July. The Bitcoin’s price soared, while gold kept struggling to regain after the precious metal suffered the biggest price drop in seven years this month.

The positive correlation among Bitcoin and gold remains positive, according to Skew, which indicated both assets are treated as a store of value in times of economic uncertainty.

Grayscale sees promising growth

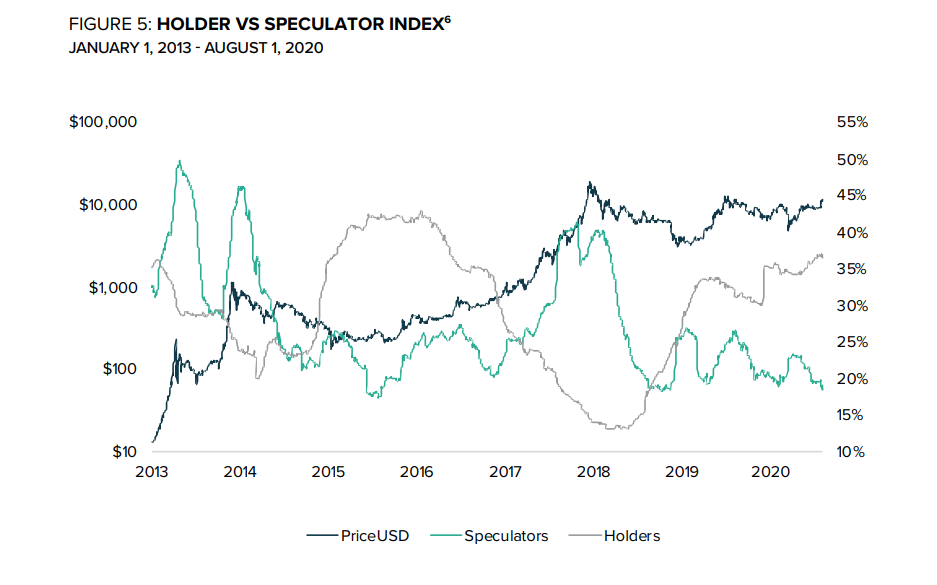

In addition to that, the biggest cryptocurrency investment management company Grayscale released the report this month, also depicting the growing distance within the amount of Bitcoins held by long-term investors and traders.

Moreover, the number of holders’ Bitcoins is constantly increasing, according to the data of Grayscale. Moreover, the leading crypto investment firm believes the growth in holder coins signifies accumulation, which is considered to be a bullish and promising indicator for Bitcoin.

Sponsored

The demand for Bitcoin is related to the current economic situation, states the report, as the benchmark crypto is more and more considered as a store of value and a hedge against inflation among institutional investors:

Amidst unprecedented monetary and fiscal stimulus, investors are searching for ways to protect against an ever-expanding monetary supply. Because of Bitcoin’s unique qualities – such as its verifiable scarcity and a supply that can’t be controlled by a central authority – we believe it can be leveraged as a store of value and as a way to escape this great monetary inflation.

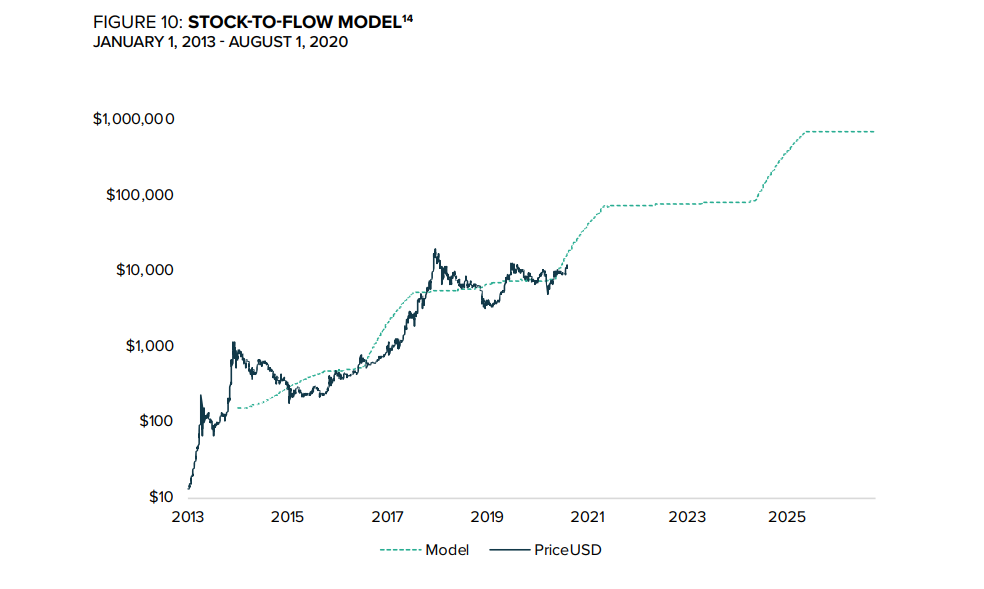

Stock to Flow ratio

The scarcity of Bitcoin becomes an even more critical factor in Grayscale’s Bitcoin value analysis. Another metric that Grayscale relies on, the Stock to Flow ratio, also indicates the future bull run for Bitcoin. According to it, Bitcoin should reach the $100.000 mark within 5 years and even grow further in the future.

Stock to Flow (S2F) ratio, or the model first published at the beginning of 2019, refers to a measure of scarcity for commodities. The analytical tool treats Bitcoin as a commodity like gold or silver, which has a finite supply. It is calculated by dividing the existing supply of an asset by its annual production growth.

The Bitcoin’s supply is limited to 21 million and the last Bitcoin is expected to be mined until 2140, having in mind the reduced miners’ reward every four years. This means that scarcity is in the nature of Bitcoin, which already makes it the store of value and gives a higher S2F ratio.

Following the logic, the higher S2F ratio indicates the lower upcoming supply and the same or more possibly the increasing value of the asset in the long-term.

According to that Grayscale reveals, that the demand for scarce monetary assets like Bitcoin should grow further if the inflation across monetary systems accelerates. In addition to that, the biggest crypto investment manager predicts that the demand for a scarce monetary asset like Bitcoin should increase even further if the currencies across the world continue to lose value