- Premier decentralized exchange Uniswap wrapped up Q3 with new, exciting updates to the network

- The Uniswap Auto Router launched, helping users automatically find better prices on their trades

- UNI, the native tokens of Uniswap, now features its first large-cap fund, thanks to a Grayscale listing

- Uniswap also announced that the Uniswap App can now fully support EIP-1559 tokens.

Uniswap has become a household name after becoming the first project to provide more than $1 billion for liquidity providers. Next-generation decentralized exchanges like Uniswap are believed to be the future of finance.

Uniswap leverages multiple crypto assets, including UNI, to provide services similar to traditional exchanges, but eliminates the need for a central operator or an administrator. So, how has this decentralized exchange performed in recent times?

Recent Developments

Uniswap had a satisfying entrance into Q4 of 2021 as Grayscale Investments, the world’s largest crypto asset manager, listed Uniswap (UNI) on one of its large-cap investment funds.

Sponsored

The Grayscale Digital Large Cap Fund (GDLC) is the first large-cap fund UNI will feature, despite being in the Grayscale Defi Fund since it launched in July 2021. While UNI contributes about 1% to the large-cap fund, it dominates the Grayscale DeFi fund, with approximately 45.20%.

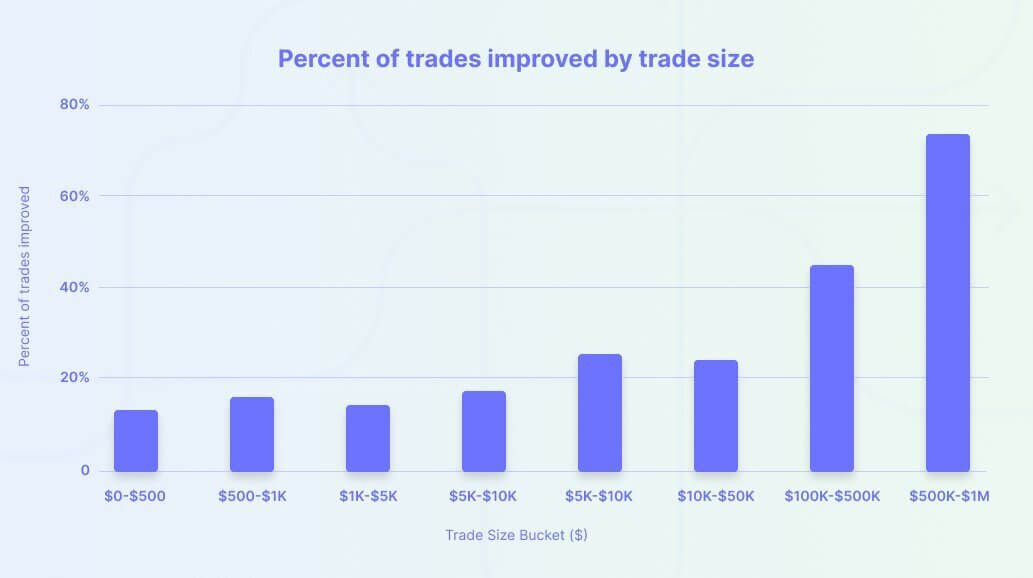

In the last fortnight of Q3, Uniswap rolled out some exciting updates in preparation for Q4. The Uniswap Auto Router was one of the new features launched on the network. Uniswap stated that its Auto Router uses advanced smart order routing algorithms to find better prices for traders in the Uniswap app.

According to Uniswap, the Auto Router has improved the pricing on 13.97% of all trades. For trades between the top 10 tokens by TVL, the Auto Router has reduced pricing by up to 36.84%.

Entering the tail-end of Q3, Uniswap announced that the Uniswap v3 deployments on Optimistic Ethereum and Arbitrum are ready to graduate from alpha to beta. In addition, the update enabled users to seamlessly access all supported networks directly in the Uniswap App.

Sponsored

To improve the speed of both Layer 2 networks, Uniswap released a fast confirmation UX. However, Uniswap added downtime detection so that the Uniswap App will report any liveness recorded of the network.

Optimism Ethereum aids Uniswap in supporting any Ethereum app. Since its launch two months ago, it has processed over 2.2 million transactions, saving over $100 million in gas fees. Optimism Ethereum currently has over 100k unique addresses. Arbitrum posts more impressive stats.

Also, Uniswap announced to its community that the Uniswap App can now fully support EIP-1559 tokens. In addition, Uniswap stated that Since the Ethereum London fork, over 43,577 ETH has been burned through transactions with the Uniswap Protocol.

Future Events

Uniswap is one of the event-driven blockchain projects. As the NFT mania grows more intense, NFT Tech, the world’s most accessible NFT Marketplace, is preparing to list on Uniswap on October 21.

NFT Tech has completed its mainnet launch, which is interoperable between Ethereum and the Binance Smart chain. The project has also announced plans to launch a liquidity matching engine down the road.

The Defiant Terminal, a protocol that enables investors and analysts to track all DeFi data in one place, is also gearing up to launch on the Uniswap Network. Upon launch, users will be able to create charts and tables in relevant metrics.

The Defiant Terminal has promised to support MakerDAO value locked against MKR price, Dai lending rates, Uniswap versus Sushiswap users, token prices for the top smart contracts platforms, and more.

Price Updates

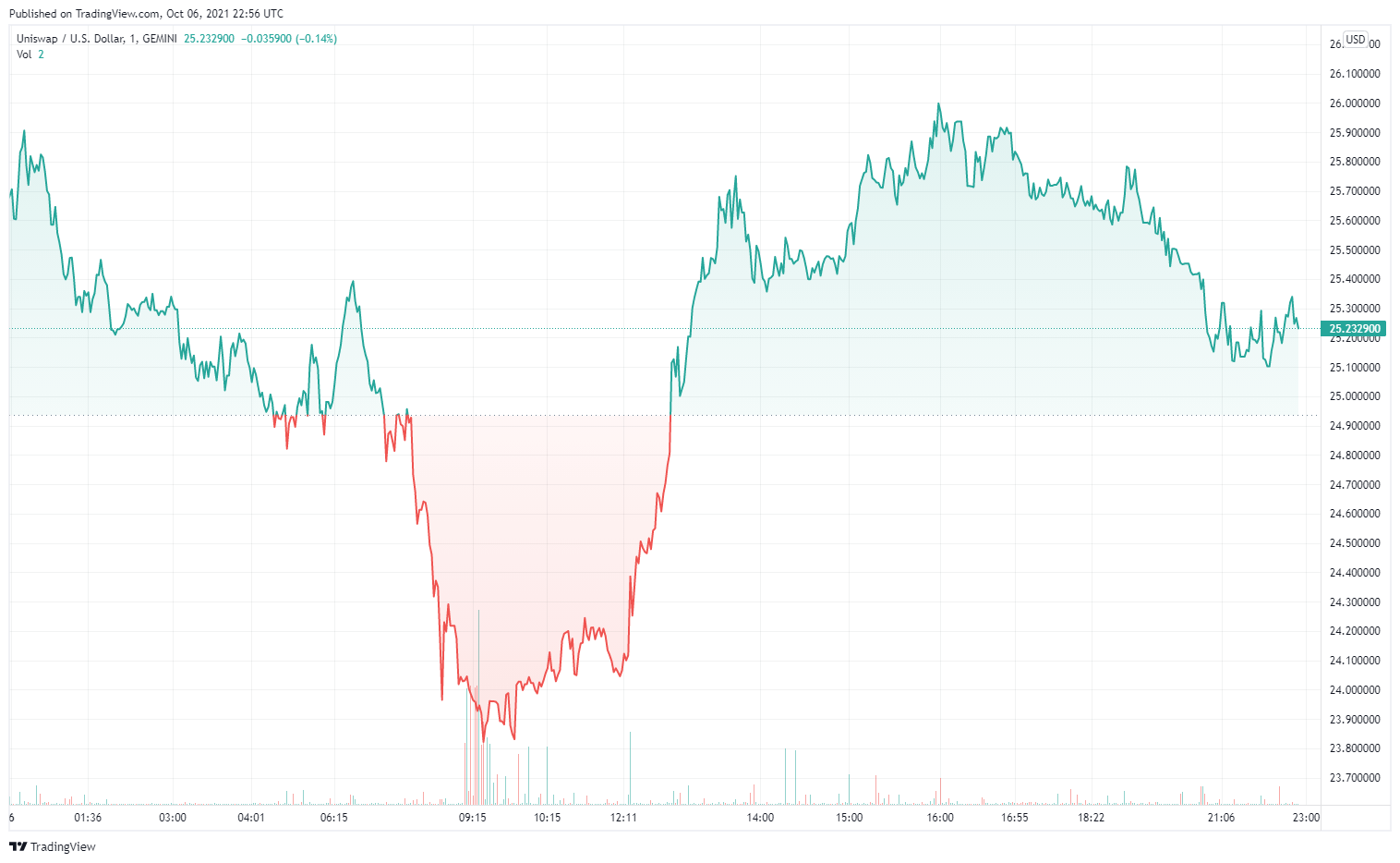

While Uniswap has been outperforming many projects in development, UNI’s native tokens have retraced and consolidated, following a huge spike amidst China’s ban on crypto.

The 24-hour price chart of Uniswap (UNI). Source: Tradingview

UNI now trades at $25.2329, after a drop of 1.47% over the last 24 hours. Uniswap still remains the 12th largest crypto project, with a market cap of $15.46 billion.

On The Flipside

- While UNI has struggled in recent times, the token remains a long-term winner

- Year-to-date, UNI has gained over 430%, making it one of the best performers

Community

As one of the foremost crypto projects and decentralized exchanges, Uniswap has built an enormous community with great networking. Members of the Uniswap community address each other as Unicorns.

Uniswap currently has one of the biggest communities, with over 53k Unicorns on Reddit, 66k on Discord, and over 647k on Twitter.

The DailyCoin team discovered that Unicorns are particularly bullish about developments in the ecosystem. Replying to the Grayscale listing, @KKB2010 wrote on Twitter;

When the chart is right, the narrative is right. Thanks @Grayscale for coming on board. Let's go to the #uni moon pic.twitter.com/W6uZgupZQh

— MR KENNEDY (@KKB2010) October 1, 2021

On the flipside, community members are always ready to call the attention of the Uniswap team to issues identified on the network. For example, with the early launch of the Uniswap Auto Router, many users drew attention to a bug.

A tweet shared by the user, @theRealMoonCat, can be seen among several members. He wrote:

It seems that all my tokens are showing insufficient liquidity on V2 and V3. If I change to V1, liquidity is present even if the tokens have their liquidity on V2/V3. Can you look into that @uniswap? Thanks!

— MoonCat (@theRealMoonCat) September 17, 2021

Another user, @Blackgirl_Alex, wrote;

I tried to use arbitrum on uniswap , wanted to swap ether to usdt but it keeps saying there is no liquidity for this trade.

— ÎŤÇHŸ 🔺🌖 (@Blackgirl_Alex) October 2, 2021

Other Unicorns are still ardent believers in the project and its prospects. A user, @bneiluj, wrote:

Great job guys. That’s impressive.

— Julien Bouteloup (@bneiluj) September 18, 2021

Why You Should Care?

Uniswap receives a lot of attention because it offers improved financial stability, greater competition, and a more diverse financial system while reducing people’s reliance on existing entities.