- Uniswap leads the DeFi industry, standing as the first project to provide more than $1 billion for liquidity providers.

- Governance continues to be one of the most discussed topics on the Uniswap network.

- Flipside Crypto requested, and lost, a $25 million grant from Uniswap to build a community-driven analytics firm.

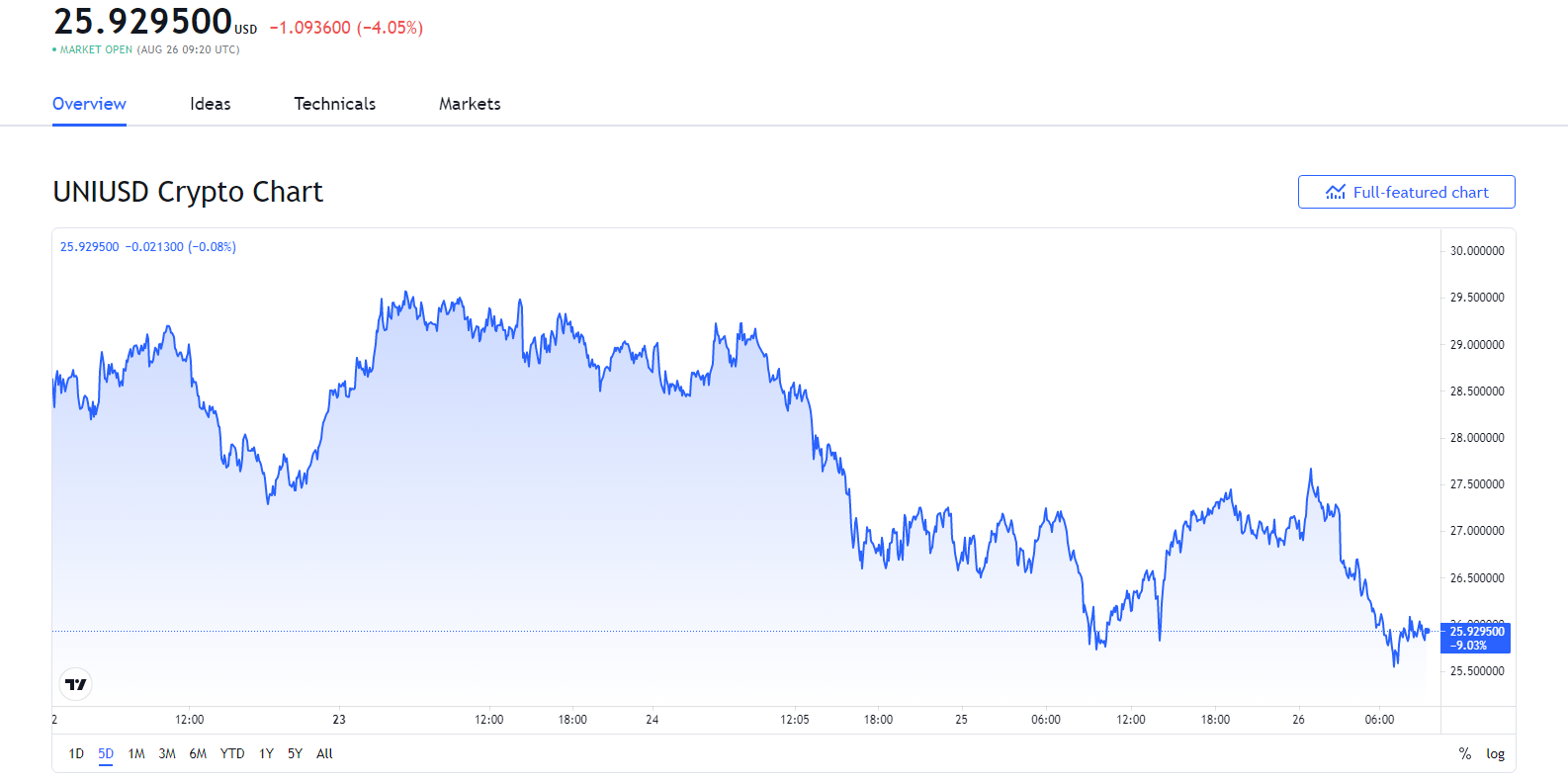

- UNI, the native token of the Uniswap network, has seen significant downswings and is now valued at $25.92 at the time of writing.

Uniswap leads the next generation of exchanges known as ‘decentralized exchanges’ (DEX). Uniswap leverages multiple crypto assets, including UNI, its native token, to provide services similar to those of a traditional exchange.

Uniswap mirrors traditional exchanges, however it implements smart contracts. As a result, users can perform transactions without the need for a central operator, or administrator. Uniswap has excelled since its launch in 2019, but how has it fared in recent times?

Uniswap Price Update

Uniswap has not been immune to the crypto market’s correction amid a blistering run that saw the cumulative market cap of cryptos eclipse $2 trillion.

Sponsored

UNI, the native token of the Uniswap ecosystem, is down by more than 4% over the last 24 hours against the USD, and its value is down by 12% from its high of $29.2.

Five day price chart of Uniswap (UNI). Source TradingView.com

Continuing its downtrend, Uniswap token exchanges are now priced at $25.92 apiece at the time of writing. This downtrend means Uniswap now has a market cap of $24.8 billion, the 9th largest amongst all cryptocurrencies.

Sponsored

The DailyCoin team explored the Uniswap community to discover its sentiments, only to discover that believers of the project are optimistic about the coming days. A Discord user known as Dan Stacking, wrote the following about the decline:

“Small dip! time to buy more.”

Recent Developments and Future Events

The governance of the Uniswap network has been the most discussed topic in recent times, and was one of the primary discussed topics in the previous Uniswap community call (#8).

Earlier in the month, data analytics firm, Flipside Crypto, submitted a proposal that sparked controversy in the network.

In the proposal, Flipside Crypto requested a $25 million grant from Uniswap to build a community-driven analytics firm. The proposal was initially opposed by Dute Analytics, who wrote;

“We call on the $UNI community to reject this misuse of funds and attempt to monopolize $UNI analytics grants. If this proposal fails, we will help establish a vendor-neutral proposal for $UNI analytics grants where funding goes to *the community*!”

Flipside Crypto quickly fell out of favor with the UNI community, and the funds were cancelled.

The subsequent vote on the Uniswap network was carried out to upgrade the governance contract to Compound’s ‘Governor Bravo.’ Currently queued to be executed, the votes ended 63,461,682 to 2,434 in favour of Compound’s governor.

The cancellation of the grant came just a week after it was announced that Uniswap had generated more than $1B in fees for liquidity providers.

Having only Launched in November 2018, Uniswap has already soared past $1 billion in fees for liquidity providers, whereas the Bitcoin network has comparatively generated $2.24 billion in fees since its 2009 launch.

Uniswap (UNI) Price: Technical Analysis

Uniswap entered the market in August, enjoying massive impulsive rallies from the lows of July, which was ultimately responsible for UNI accumulating gains of more than 110%.

The 4H chart of UNI, showing its bull-run from July to its Aug. peak of 31.3. Source: Binance

Since then, Uniswap has displayed a lack of bullish momentum since failing to recapture the resistance of $29 on Tuesday, Aug. 24th, the result of which has been a decline of more than 11% in the last 72 hours.

The 1H chart of UNI. Source: Binance

The 1H chart of Uniswap shows the token price hit a snag between the support level at $25 and the resistance at $29. Future bullish momentum causing UNI to break above the $29 resistance level would see the token retest the highs of $31 last registered on Aug. 16th.

While the direction of UNI still looks indecisive, the next support level for the coin sits at $22.71, and As of this moment, momentum is looking rather bearish.

In the last week, UNI’s trading volume has dropped by over 52%, from as high as $699.1 million, down to $349.1 million at press time. In addition to this, the overall circulating supply of the coin has decreased by 0.5% to 611.6 million. This puts its current circulating supply at an estimated 51.99% of its max supply of 1.00 billion. Market cap ranking places Uniswap as the 11th largest cryptocurrency at $15.8 billion.

On The Flipside

- Uniswap could face serious challenges for its position in the DEX sector.

- The trade volume of Pancake Swap has eclipsed Uniswap’s, with new entrant, ADAX, positioning itself as the UniSwap of Cardano.

- Solana (SOL) has also passed UNI in the crypto rankings, claiming the 10th position after the token soared by more than 70% over a seven day period.

The Uniswap Community

The cancellation of the Flipside Crypto proposal highlights just how involved the Uniswap community is in the governance of the network.

After the call, there were debates among the Uniswap community, joined by Jason Choi, a general partner at The Spartan Group. A Twitter user, identified as Jeff Amico wrote;

“a16z voted AGAINST the Flipside Crypto @Uniswap proposal. We appreciate the hard work of @flipsidecrypto in bringing this proposal forward, and believe a modified version of it could be successful, but we do not think the current version should pass. Here's why: [thread continues]”

After multiple debates, Twitter replies, and threads, the grant was cancelled after garnering 46.9 million votes against it, demonstrating the level of community involvement within the Uniswap.

Why You Should Care?

Decentralized Finance (DeFi) is quickly emerging as a replacement for centralized finance. Uniswap is the leading DeFi project, being the first to pass $1 billion in liquidity fees. DeFi technology is being hyped because it offers improved financial stability, greater competition, and a more diverse financial system, while reducing people’s reliance on existing entities.