The coronavirus pandemic has already cut world’s production by three percent this year. Furthermore, it is pushing the global economy into the deepest recession of the last century.

The International Monetary Fund (IMF) announced its quarterly World’s Economic Outlook this Tuesday. The report named the coronavirus pandemic the Great Lockdown and claimed it the worst recession since the Great Depression in the 1930s, far worse than the Global Financial Crisis.

As Bitcoin currently shows positive correlation with the global stock markets it is important to keep in mind the recession. The movements in S&P 500 (SPY) index very possibly might be mirrored in the virtual currency markets.

The global growth fell 6.3%

According to the International Monetary Fund, if the pandemic recedes in the second half of this year, the global economic growth in 2020 will fall to 3%. This is a downgrade of 6.3% points compared to this January.

Sponsored

If the coronavirus will be controlled and policy actions around the world will be effective in preventing bankruptcy and job losses, the Fund predicts that the economy will recover to 5.8% in 2021.

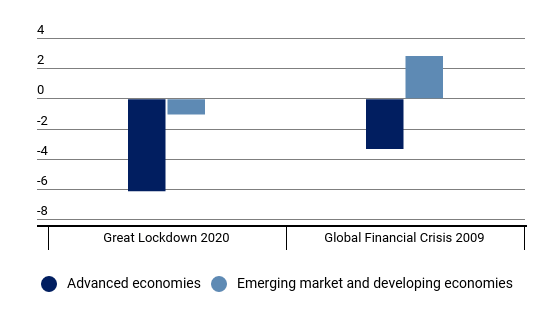

The current lockdown is the first economic contraction since the Global Financial crisis. Although the effects of the 2008 crisis have been felt for a long time, the economic downturn then was 0.1% and emerging market economies continued to grow at a rapid pace.

Meanwhile, now for the first time since the Great Depression both advanced economies and developing economies are in recession. Income per capita is projected to shrink for over 170 countries, says the IMF’s report.

What does it mean for Bitcoin?

The narratives about Bitcoin’s value have shifted over the years, and continue to be debated today, says Coinmetrics, the cryptocurrency analysis firm in its investigative report, published on Tuesday.

Sponsored

Among other narratives there is one, claiming that Bitcoin is an uncorrelated financial asset. However, the global market crash last month showed that Bitcoin, on the contrary, was very positively correlating with the S & P 500 (SPY) index and gold. The correlation even increased to the all time highs on March 12th, when both crypto and stock markets experienced historic losses. Despite the short decline to a relatively normal level in the end of March, the Bitcoins correlation with SPY has been rising again.

Nevertheless, financial analytics do not take this as a serious signal that from now on both crypto and stock markets will be correlating. They explain the short-term correlation as a result of a market panic, when investors worldwide started massive sell-offs.

Furthermore, they add that during the past year, Bitcoin and the S&P 500 have had a correlation close to zero, meaning, that two variables have no

relationship and act independently of each other. The fact shows that Bitcoin and the S&P 500 are not significantly correlated under normal market conditions.

However, it is precisely the market conditions that are now not normal. As they have significantly changed during a month, CoinMetrics predict that as long as the global economic crisis will be affecting both markets, there might be relatively high correlation between Bitcoin and S&P 500.