- There are over 2,000 failed crypto projects

- BitConnect, now a deadcoin, once ranked among the top 10 cryptos with a market cap of over $2.9 billion

- PayCoin, an acclaimed stablecoin that hit a market cap of $180 million currently holds no substantial value

Cryptos represent an emerging industry with a lot of potential and diversity. One of the most discussed topics around the crypto space has always been alternatives to the pioneer crypto, Bitcoin.

From 2009 till date, there have been more than 9,000 crypto projects. As the number of launched crypto projects increase, so has the number of failed projects increased alongside. The term deadcoin is used to refer to crypto projects that have either failed or ceased to exist.

There were more than 500 failed crypto projects by the end of 2017, and over a thousand by 2018, and two thousand by 2020. While some of these projects are still ‘active’ they are considered deadcoins because of the great disparity between what they promised and what they offered or are offering.

Sponsored

Here is a look at the top five crypto failures of all time and the reasons why these projects failed.

1. PayCoin (XPY)

Starting the list is PayCoin, a project launched by respectable and accomplished crypto miners, Josh Garza and GAW. When the cloud mining crypto project, PayCoin, was launched in 2014, the team was acclaimed to have amassed a great deal of knowledge in the crypto space.

Sponsored

How bad has PayCoin failed? Shortly after its launch, the XPY coin peaked above $15.92 and held a market cap of over $180 million. However, as of the time of this writing, the XPY is valued at $0.003772 with a market capitalization of $45,245. So, what happened to PayCoin along the way?

What Went Wrong?

PayCoin, sold as one of the first stablecoin, is a classical example of promising more than you can offer. The founders promised investors that the stablecoin would be valued at $20.

This crypto project was however rushed in an attempt to market it to users and this compromised its security, as a result, PayCoin came crashing down when most of the promises made by the founders failed to materialize.

Even though PayCoin was once ranked as one of the largest cryptos by market cap, the project failed to offer any real value to its customers. PayCoin turned out to be one of the very first crypto Ponzi schemes, and the project was shut down shortly after it started.

In 2018, the CEO of now-defunct GAW Miners, Josh Garza, was sentenced to 21 months in prison and ordered to pay $9.2 million in restitution to investors.

2. BitConnect (BCC)

Anyone who has been around the crypto space long enough would have heard about BitConnect. At its peak, Bitconnect was one of the largest cryptos. In 2018, it comfortably ranked in the top 10 cryptos with a market capitalization of over $2.9 billion.

In January 2017, the BBC coin exchanged hands at $0.16767 per coin, however, in January 2018 the BCC coin traded as high as $472 per coin. Today, BCC is one of the deadcoins, with absolutely no value.

What Went Wrong?

BitConnect was accused of creating a large-scale financial pyramid. In the first few months of its launch, the project ran smoothly, about the best debut year of any crypto project ever – a return on investment of over 2,950 percent in its first year.

As 2017 wound up, cryptocurrency investors came out to publicly accuse the BitConnect project of organizing an investment scam — also known as a crypto Ponzi scheme today.

The move against the project stemmed from the project promising more than it can offer. BitConnect promised its investors significant bonuses for depositing Bitcoin on their platform. However, according to disgruntled investors, the bonus payment mechanism remained opaque.

Furthermore, the nature of the bonuses was not made know. As a result, many in the community began to suspect that the project represented a financial pyramid built on top of a multilevel referral system.

Analysts and critics pointed out that the only source of the Bitcoin bonuses would be from new investors. The founders of the project whose real identities remain unknown never clarified the information rather chose to keep it secret.

The project began to collapse when the Texas and North Carolina regulators forced the founders to shut down the operations along with the cryptocurrency exchanges where they were listed. In no time, the BitConnect (BCC) token was redundant and subsequently caused it to depreciate.

Shortly after that, collective lawsuits from investors and regulators began to be filed against BitConnect. As a result, the United States authorities took over the investigation on the activities of the project — which led to a U.S. court deciding to freeze its assets.

At the time, popular billionaire and Bitcoin investor Mike Novogratz, who Tweeted, “BitConnect really seems like a scam. an old school Ponzi… bad actors hurt the community. period.”

On the Flipside

- Mastercard has announced that it will begin to support digital currencies on its platform this year

- The move follows the likes of PayPal and Visa and will allow millions of merchants worldwide to accept crypto payments

- The payment giants revealed that it will consider carefully which coins to support, mainly focusing on consumer protection and compliance

3. Ethereum’s DAO

Ethereum DAO which stands for the Decentralized Autonomous Organization is one of the most memorable failed crypto projects in the industry. Its failure is quite historic because people had such great expectations about the project.

The project launched in April 2016 (after completing a successful crowdfunding campaign) as it sought to create a type of investor-directed venture capital fund. However, by September 2016, Ethereum DAO was delisted on many of the exchanges it traded on and had, in effect, become defunct.

What Went Wrong?

During the crowdfunding of DAO, a lot of people felt connected to the project and its success. In fact, the project once contained 15 percent of all the Ether in circulation. At the time, DAO was the largest crowdfunding project, having raised over $150 million from more than 11,000 enthusiastic members.

However, it can be said that the effort put into the marketing of the Ethereum DAO exceeds the effort put into developing the project, because, five months after its launch, the Ethereum DAO was a deadcoin.

The project was based around a group of people writing smart contracts (programs) that will run the organization and keep the Ethereum ecosystem safe. This project that was created to keep the Ethereum ecosystem safe, was hacked.

As programmers worked on fixing issues with smart contracts and other problems on the blockchain, an unknown attacker gained access to the framework using the same approach. The hacker proceeded to drain the DAO of ether collected from the sale of the DAO tokens.

By June, the attacker had managed to siphon over $3.6 million in Ether (ETH) into a “child DAO” that has a structure similar to that of The DAO. The price of ether dropped from over $20 to under $13.

One major failure of the project was dumping all the Ether it raised into a single address. According to the creators of the project. They were not prepared to receive as much as they raised during the crowdfunding of the project.

The hacker was able to come back for more, and when people attempted to split The DAO to prevent more ether from being taken, they failed because they could not get the required votes (typical of smart contracts) in the short period.

The hacker will proceed to claim more than $50 million of the money raised. This invasion of the system would signal the beginning of the end for the Ethereum DAO.

4. Bitcoin Diamond (BCD)

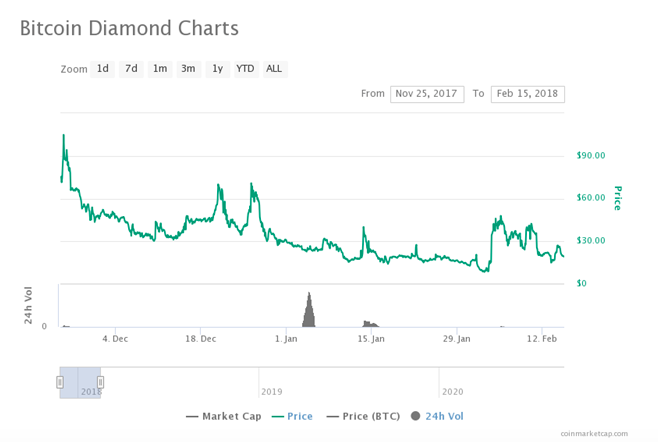

Bitcoin Diamond (BCD) was created in November 2017 as a fork from Bitcoin. The project separated from the Mainchain of Bitcoin after completing block #495866. It maintained the same objectives as the original Bitcoin – create a means of payment that is convenient for online purchases.

Bitcoin token holders who participated in the fork were rewarded with BCD tokens. The accrual was carried out at a ratio of 1 BTC to 10 BCD. This meant that the max. supply of BCD tokens was set at 210 million, while 170 million tokens were released upon launch.

Coming from the Bitcoin Mainchain, the project increased the speed of each block, created a new encryption method for solving issues of confidentiality, and increased the block size on the blockchain.

The roadmap of the project promised investors that, by the beginning of 2020, Bitcoin Diamond should surpass Bitcoin in terms of its use cases. However, Bitcoin is still the number one crypto in terms of adoption and market cap today.

What Went Wrong?

At the time of the fork, the BCD token traded as high as $85 apiece, however, it is currently valued at $1.12. Although not a deadcoin, the change in the value of Bitcoin Diamond marks a price drop of more than 97 percent.

The problem of the project is that the plan for the development of its roadmap was rather uncertain, posing more questions than answers. The roadmap although promising great ambitions never truly described how it would get there.

Bitcoin Diamond began to fall out of favor with investors when the Ledger announced that the project was involved in fraudulent schemes at the end of 2017. It opined that;

Customers switched to websites related to cryptocurrency, on which they were asked to enter a password, and their BCD tokens were subsequently stolen in a classic case of website cloning.

The project is still operational and has often been referred to as a work in progress, with many asking when work on the BCD token will be completed?

Only the Strong Survive

More than the hype, the crypto market is a growing, yet competitive industry. With the growing number of projects, only those that offer not just a great plan, but has a strong team capable of pulling it off survive and thrive in the industry.

One of the best pieces of advice given to investors is to stay away from low-liquidity instruments, which do not possess a stable influx of money. To avoid losing your investments, we have compiled a list of ways people lose their crypto holdings, and how you can avoid them.