- Strike allows its U.S. users to buy and sell BTC for almost zero in fees.

- Company’s CEO Mallers spent most of the announcement railing against Coinbase for its fees.

Another major player entered the game and now is aiming at the hottest thing in town status. Payments app Strike met July by launching a Bitcoin service that allows users to buy BTC with no added fees. Not only that – they also criticized Coinbase for charging users arguably excessive fees.

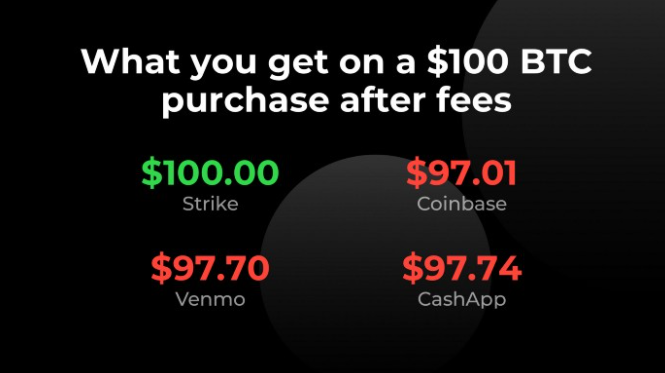

On Thursday, July 1st, Jack Mallers – CEO of crypto payment app Strike, created by Zap Solutions – issued an announcement that his global payment system will now enable users to buy Bitcoin. He went on to boast that Strike BTC purchases will be “near-zero” and much cheaper than the fees for purchasing Bitcoin on Coinbase, Venmo, or CashApp. Those sites charge between 2-3% of the transaction amount to cover costs. Here’s a graphic embedded in the announcement that Mallers used to make his point.

But what’s confusing is that while Mallers spent most of the announcement railing against Coinbase for its fees, he acknowledged that Strike is charging 0.3% to cover its own transaction expenses.

Sponsored

As of typing, our execution costs are below 0.3%, and we expect that to drop below 0.1% over the coming months as our volume grows. The more our volume grows, the less our partners charge. We’re committed to driving the price to buy bitcoin on Strike down to as close to zero as we possibly can.

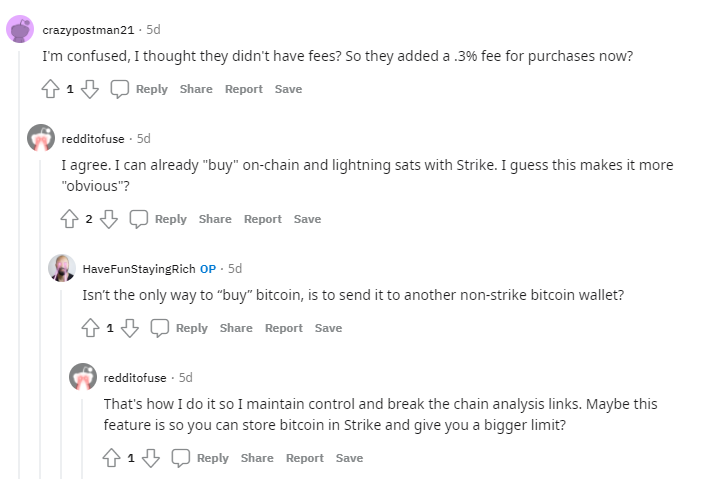

That’s not a guarantee the 0.3% transaction rate will ever be eliminated – it could remain in place for years as they wait for usage volume to grow. Also, Mallers’ vaunted 0.3% is not 0%. In fact, it’s three-tenths of a percent. Using Mallers’ own example above, a $100.00 purchase of Bitcoin on the Strike platform will cost users $0.30 cents per purchase. While that’s cheaper than $3.00 per transaction, $0.30 is still more than zero. As such, the chart above that Strike produced is misleading. The “green” $100.00 should actually be a “red” $99.70.Further adding to the confusion, this exchange between Strike users on Reddit clearly shows that some of its fans assumed Strike already had zero fees in place.

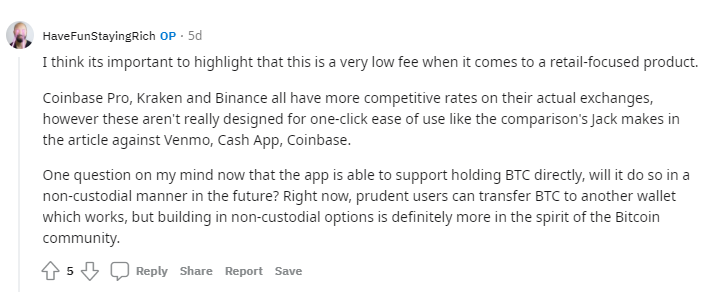

Another point of confusion that Mallers created and failed to address in the announcement was custodial care of the Bitcoin once purchased on the Strike platform. That exact point was raised by this Redditor.

In his post, this Redditor writes:

Sponsored

One question on my mind now that the app is able to support holding BTC directly, will it do so in a non-custodial manner in the future? Right now, prudent users can transfer BTC to another wallet which works, but building in non-custodial options is definitely more in the spirit of the Bitcoin community.

This is an important question that Mallers announcement completely ignores. It raises the question of who owns the private keys that allow access to the Bitcoin once it’s bought and stored on Strike. Non-custodial exchanges/wallets entrust the private keys to you – the asset owner. Whereas custodial exchanges such as Coinbase and Robinhood control the private keys.

In its announcement, Strike failed to address this critical consideration. Will it be a custodial or non-custodial exchange/wallet? That’s a pretty big miss.

Oh well, when you’re bloviating about how great your nominal “near-zero” fees are, why bother addressing crucial investor concerns such as private key management and digital asset security.

Strike tried to hit hard with this news, but they missed the mark where it matters most to retail investors.

On the Flipside

- Not really sure why 0.3% transaction fees for one cryptocurrency (e.g. Bitcoin) is that big a deal. Hasn’t Robinhood been offering FREE transactions since inception as well as clarity regarding its custodial arrangement, which Strike has not?

- If Mallers really wants to do something about excessive costs, try doing something about lowering the gas fees on the Ethereum network. Then we’ll stand up and cheer!