Wednesday afternoon the Federal Reserve issued its final Federal Open Market Committee (FOMC) statement for the year. The announcement stated that the Fed planned to reduce its bond purchases of Treasury and mortgage-backed securities by a total of $30 billion a month across both asset types. The goal of this tapering is to work toward ending its bond-buying purchase program in March 2022 – a full quarter sooner than previously announced.

The Fed also opened the door for three rate hikes to its federal funds rate in 2022, instead of one increase. The federal funds rate is the baseline for bank lending, which means average consumers will likely see high rates on their credit cards, car loans, adjustable-rate mortgages, and more.

Fed Chairman, Jerome Powell, said the reasons for these actions are that inflation has been trending higher than their 2% target for several months and new jobs have averaged 370,000 per month, which the Fed believes are signs of strong economic growth.

Sponsored

In a televised press conference following the release of the FOMC statement, Fed Chairman Jerome Powell said he and the FOMC recognize the impacts that their monetary policies have on average consumers.

“We understand that our actions affect communities, families and businesses across the country. Everything we do is in service to our public mission. We, at the Fed, will do everything we can to complete the recovery in employment and achieve our price stability goal,”

Powell said.

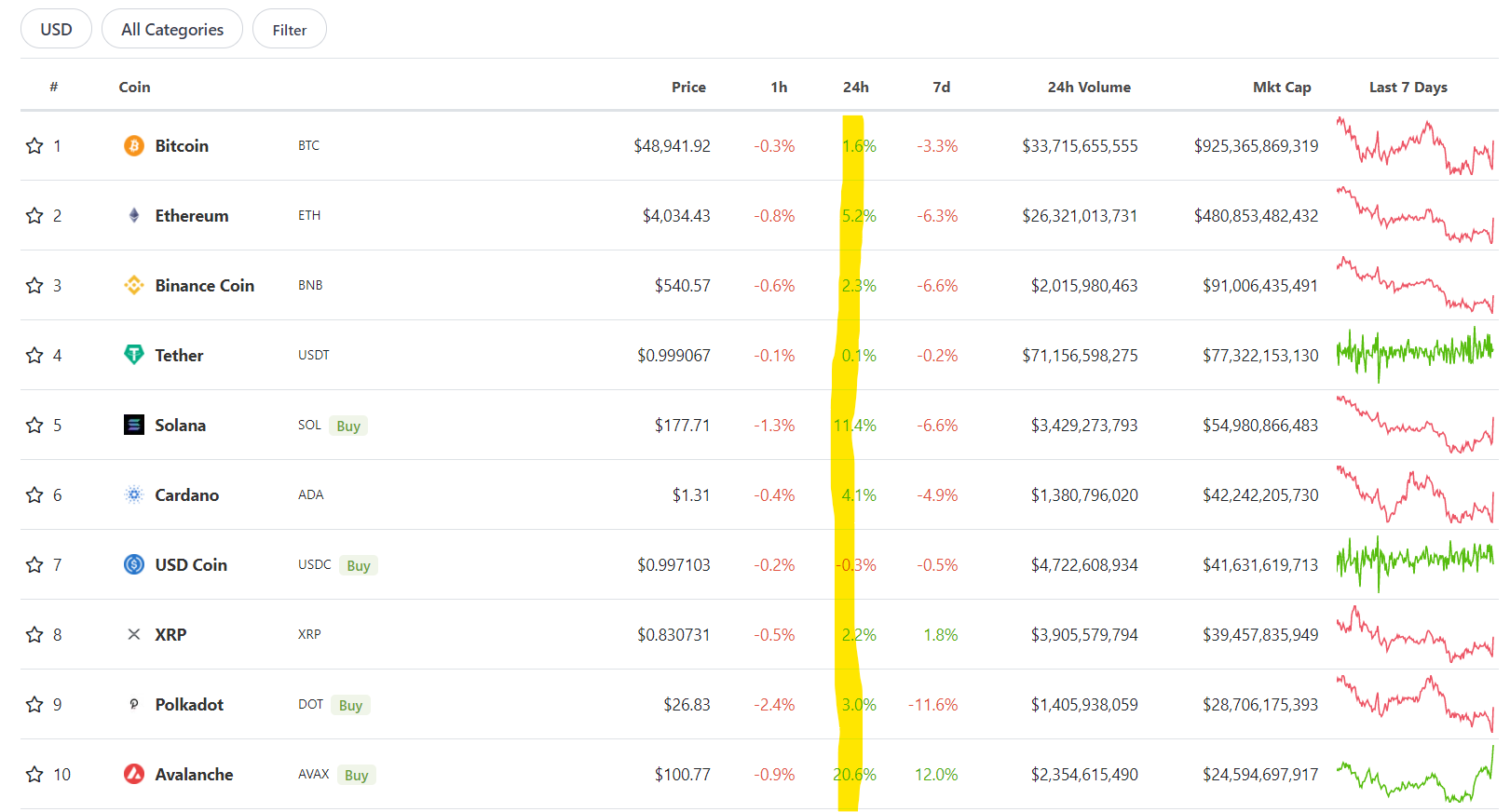

Following the Fed’s announcement at 2p.m. EST there was an instant price increase across the crypto-space of about 5% but has since retraced in the 1-hour view. Yet, the pump was enough to push the 24-hour pricing averages in the green for 9-of-the-top-10 cryptos, per CoinGecko.com.

On The Flipside

- Both the crypto and stock markets popped more than 5% after the Fed news.

- It’s interesting to see both those sectors move in tandem – it implies that cryptocurrencies are still correlated to traditional finance and not yet decoupled.

Why You Should Care?

Generally speaking, rising inflation hurts consumers as could accelerated interest rate hikes. The best thing for everyday consumers to do is pay down your credit card debt as soon as possible to avoid spikes in credit rates next year.

Sponsored