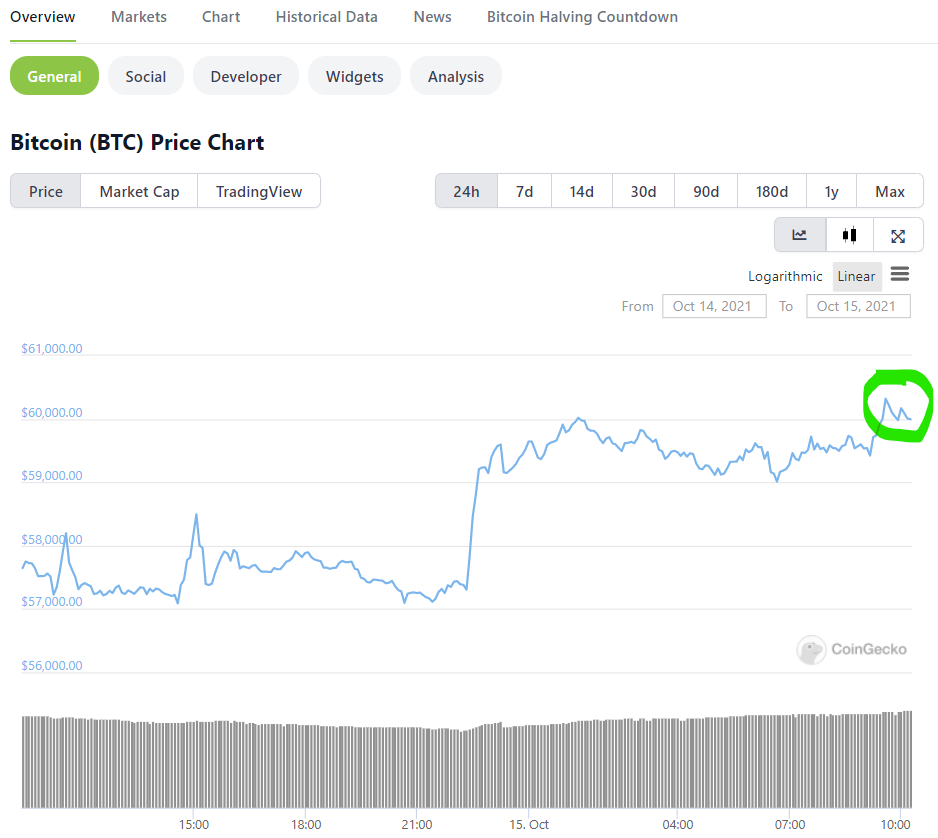

Earlier today Bitcoin, breached the significant psychological barrier of $60K U.S. before dipping below it as seen in this chart from CoinGecko.

Bitcoin has not seen these pricing levels in several months, and it’s drawing ever closer to its all-time-high of nearly $64K set back in April of this year. Several technical analysts and influencers within the cryptocurrency space are projecting that Bitcoin could reach $100K per coin or higher by the end of this year.

These predictions are based on the converging bullish patterns on the technical charts, underlying fundamentals, and investor sentiment. From a technical perspective, expert cryptocurrency technical analyst and YouTube influencer, MMCrypto, today told his 460K subscribers that once Bitcoin gets a daily close above the $61K level with ample trading volume, he estimates the next price level will blow through the previous $64K all-time-high – all the way to $75K at a minimum. We’ll watch for that!

Sponsored

From a fundamental perspective the base case for Bitcon has never been stronger as flawed monetary policies flow from the Federal Reserve, Congress continues its reckless spending spree, and inflation continues to increase for the fifth month in a row.

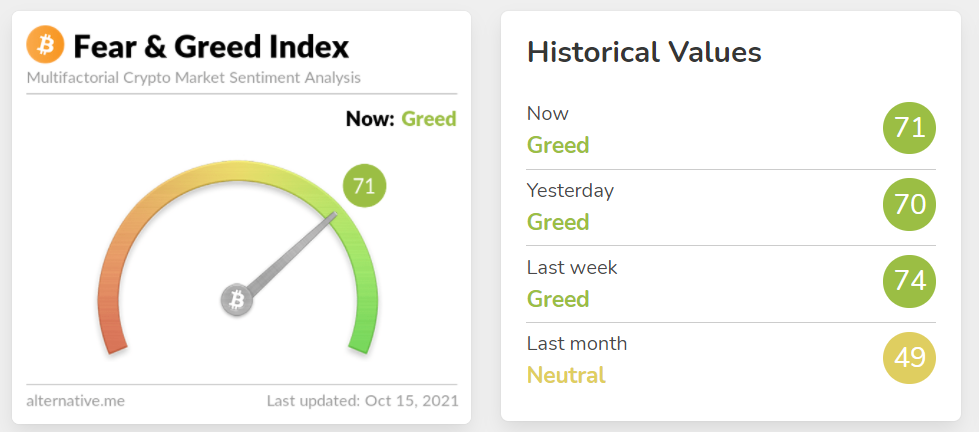

From an investor sentiment perspective, the Fear and Greed Index (FGI) suggests that investors are piling into Bitcoin. The FGI, is a free, easy-to-understand, interactive dashboard that provides a daily snapshot of the general market sentiment based on a variety of weighted factors that include: volatility, market volume, social media, dominance, and trends.

The software automatically scrapes the Internet and updates these factors every 24 hours.

Sponsored

The algorithm then calculates the FGI score for the day, and then plots it on a 0-100 scale with 0-50 representing varying degrees of Fear and 50-100 representing varying degrees of Greed. Today’s score posted below shows the FGI ticked up to 71.

Compared to last month’s FGI rating of 49, it surely seems that the bulls are in control regarding sentiment.

On The Flipside

- We have to keep watch of larger macroeconomic trends. The Everglade real estate meltdown in China and current economic collapse in Lebanon could hinder crypto gains if those types of geo-political and economic issues get worse.

Why You Should Care?

It’s an exciting time to be in crypto for us hodlers. Remember to take profits on the way up so you have resources to reinvest when the bull run ends.