- The decentralized Ethereum staking protocol, Rocket Pool, has been one of the best-performing cryptos, gaining over 75% in the last 30 days.

- The rally comes amidst a landmark that has seen Rocket Pool’s TVL cross $1 billion for the first time.

- Rocket Pool’s rETH has also been launched on MetaMask Wallet, Vesper Finance, Silo Finance, and Yield Protocol.

- The community is currently voting on a proposal to ensure that Rocket Pool doesn’t grow to the detriment of the Ethereum network.

Project Review

Rocket Pool is the first truly decentralized Ethereum staking pool that allows users, dApps, and businesses to earn rewards on their ETH holdings. With Rocket Pool, users can join the decentralized node network or run their nodes with only 16 ETH.

On Rocket Pool, Ether holders can lock up as little as 0.01 ETH and receive the rETH liquid staking token in return. rETH is what proves a user is entitled to staking rewards over time and accrues yield for them.

Rocket Pool node operators receive up to 7.26% per year, while stakers receive 4.68%. Stakers receive their rewards in RPL, while node operators stake RPL on nodes as collateral for any penalties they incur.

Sponsored

Social Media: Website | Twitter|Discord | Medium | Redidit | YouTube

Recent Developments

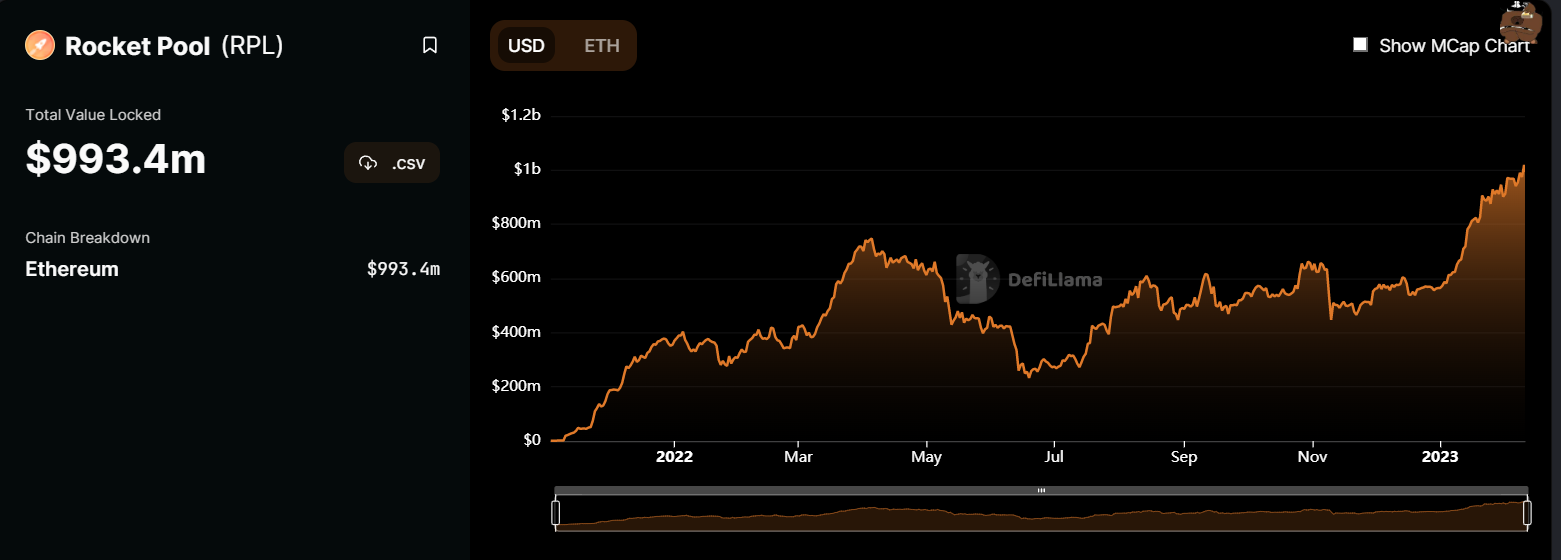

The low entrance to ETH staking on Rocket Pool has made it one of the most used decentralized staking platforms. In December, the project had an average total value locked (TVL) under $600 million.

Sponsored

However, the project has now celebrated crossing the $1 billion TVL mark. At this writing, over 2,000 node operators have staked 385,920 ETH coins on the Rocket Pool network. A drop in the price of ETH in the last 24 hours now has Rockel Pool’s TVL slightly under the $1 billion mark.

The total value locked (TVL) in Rocket Pool. Source: DeFiLlama

Rocket Pool was one of the protocols to partner in the latest MetaMask staking service launch. As part of the launch, users can now stake on the MetaMask app using the Rocket Pool protocol.

Rocket Pool has also received increasing attention in decentralized finance (DeFi). In February alone, Vesper Finance, Silo Finance, Yield Protocol, and Index Coop launched support for Rocket Pool’s rETH token.

With the recent crackdown on centralized staking providers, including Kraken, there are predictions that Rocket Pool could receive more attention, especially as we approach the date for the unstaking of Ethereum on the beacon chain.

Price Updates

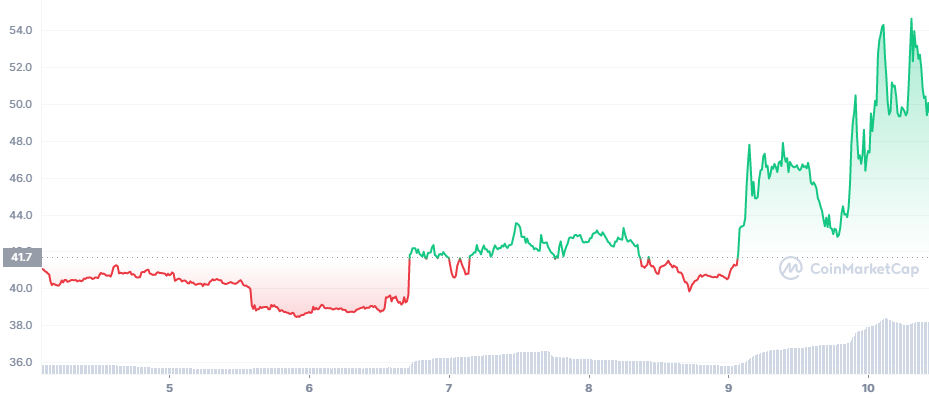

The growing attention received by the Rocket Pool protocol translates into its native RPL token being one of the best performers in the market. In the last seven days, the price of Rocket Pool has jumped by more than 13%, reaching a 12-month high of $51.13.

The 7-day price chart for Rocket Pool (RPL). Source: CoinMarketCap

In the last 30 days, the price of RPL has been up by more than 75%. However, following its incredible rally, RPL is now -2.4% over the last 24 hours and now trades at $45.41. Rocket Pool has a market cap of $467.6 billion, making it the 83rd largest crypto.

The 1M price chart for Rocket Pool (RPL). Source: CoinMarketCap

Future Events

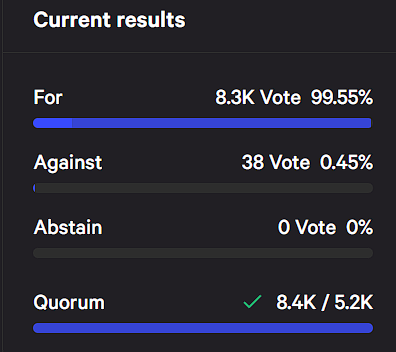

As the Rocket Pool ecosystem grows, the team is implementing measures to ensure the protocol remains decentralized and secure. A proposal has been put forward by author Valdorff to ensure Rocket Pool doesn’t grow to the detriment of the Ethereum network.

If passed, the proposal will see Rocket Pool establish a guiding set of principles to inform the decision-making process on the protocol in limiting the percentage of staked ether in its ecosystem. Snapshots show that over 99% of the voters favor the proposal.

The Rocket Pool team is also preparing for the launch of Atlas ahead of the upcoming withdrawal fork (the Shanghai Upgrade). The proposal will also allow for easier motion of ETH from the rETH contract to the deposit pool

A key part of the proposal is to keep maximum (APR) drag in mind when the withdrawal fork happens. More than 99.78% of the voters favor the proposal being passed by its deadline, February 13th.

On the Flipside

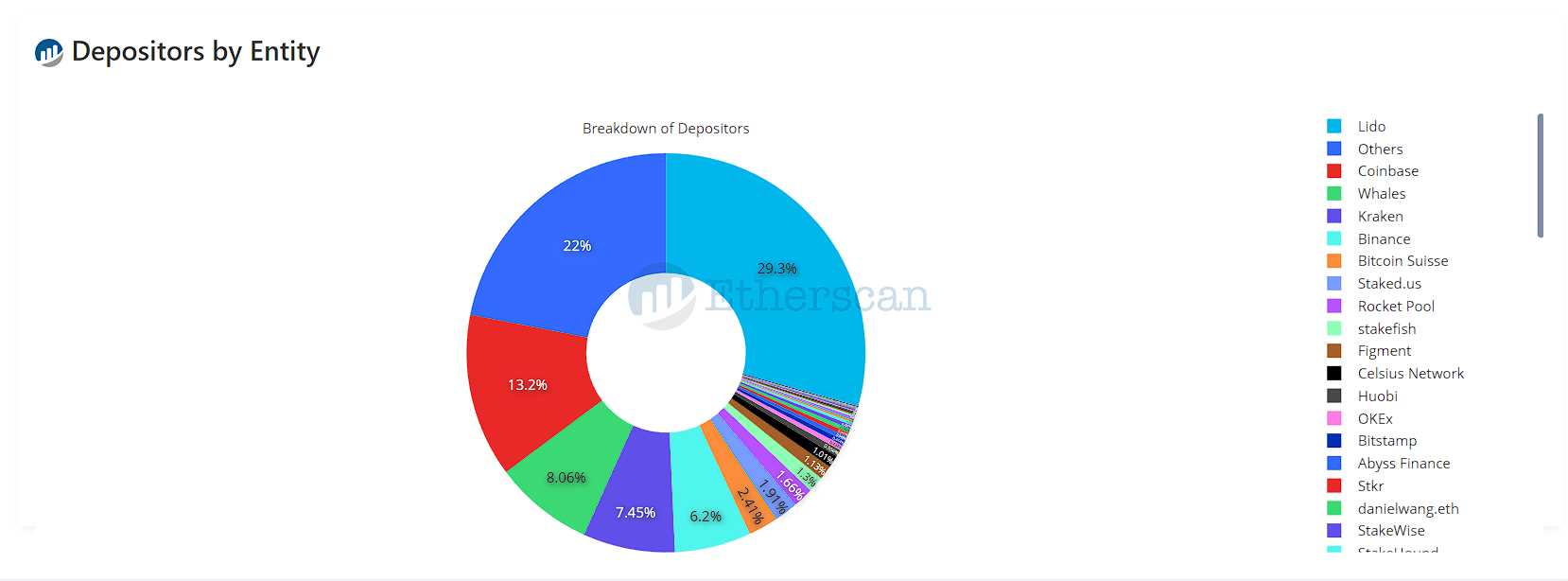

- Per the proposal, Rocket Pool is far away from being the single reason for the collapse of the Ethereum network.

- While it contributes only 1.66% to all the staked ETH deposits, its competitor Lido Finance contributes more than 29%, per data from Ether Scan.

Community

Rocket Pool is a fast-growing community. It also has highly involved enthusiasts dedicated to onboarding new members and teaching them how to run nodes and navigate the network.

Here’s how @Jasper_ETH, a popular advocate for the protocol, describes the Rocket Pool community:

When planning to decentralize it appears the VC investors are silent.

— jasperthefriendlyghost.eth | jasper.lens (@Jasper_ETH) February 8, 2023

Meanwhile, the @Rocket_Pool community analyzes and dissects every decision.

If Rocket Pool and Lido designs are converging, I'd rather be on the side that already has a community.

Can't copy culture. pic.twitter.com/4sxyJChZ5U

Reacting to Kraken shutting its staking service, crypto analyst @SeffertFlorian writes:

It is time to spin up your https://t.co/Y6tMABsXkq guys... @Rocket_Pool has you covered! https://t.co/UZYD4ImNHd

— Florian Seffert 🏴 {seffert.eth} (@SeffertFlorian) February 9, 2023

Bullish about the prospects of RPL, node operator @shf_ryn tweets:

The amount of bullish news leading up to Shanghai and @Rocket_Pool's LEB8 implementation has been insane. Another milestone in the books for $RPL. https://t.co/RjfI78nOgj

— ShfRyn (@shf_ryn) February 2, 2023

Why You Should Care

The mission of Rocket Pool has been to encourage small and independent home stakers in alignment with Ethereum’s core values. The proposals show the protocol’s desire to stick to these values.