OpenSwap has set a date for the launch of its new Spot Price Queue feature, which will be available from the week of the 25th of October.

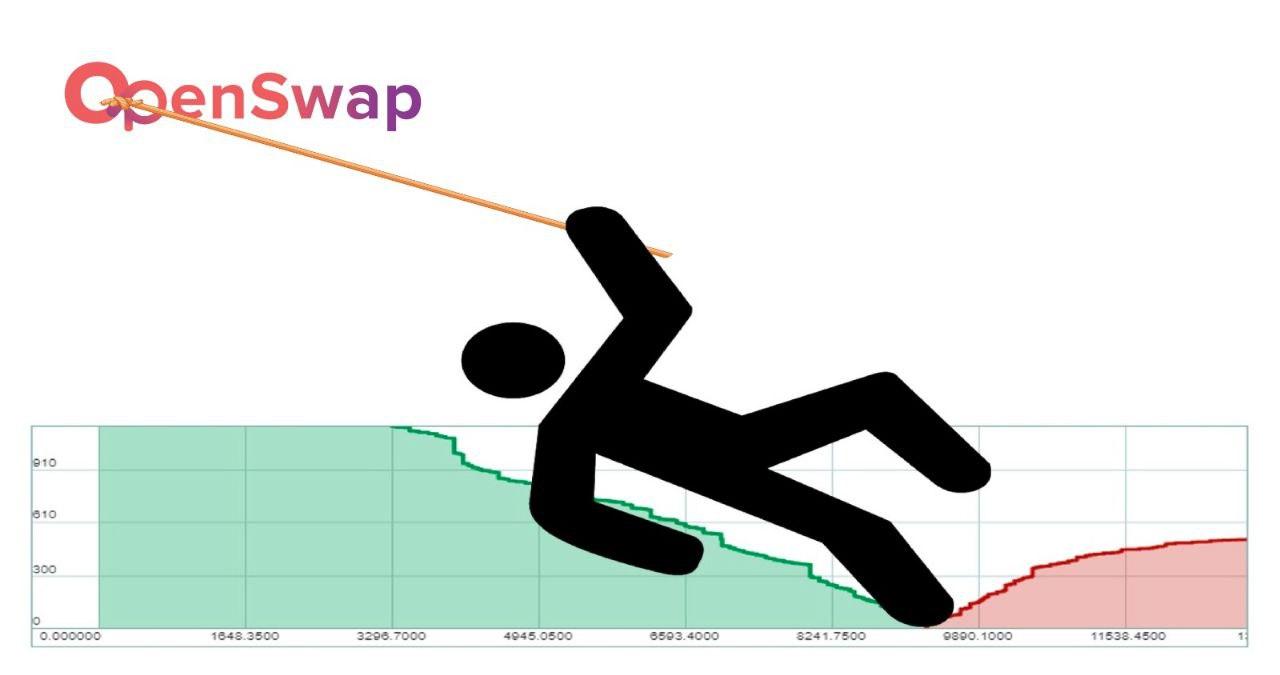

OpenSwap’s Spot Price Queue feature is going to be a game-changer for on-chain swaps, guaranteeing zero slippage and spot market price execution for crypto traders, in contrast to the standard AMM architecture where traders have nearly zero guarantees of what the final price of their trade will be.

Spot Price Queue is another of the numerous products offered by OpenSwap, and it has been created for token pairs that already have liquid off-chain spot markets. Spot Price Queue uses secure oracles through its Secure Adaptor Protocol, an oracle controller module that protects against sudden price hikes, manipulation and front-running.

There will be two varieties of Spot Price Queue, one designed for traders who need to exit their position quickly, while the other is meant for low time-preference traders.

Sponsored

The former, Spot Priority Queue, executes single-price transactions ordered by the trader’s desired priority, which is expressed by staking OSWAP. The higher the amount, the more tokens will be sold at optimal execution parameters (no slippage) given available liquidity from the other side of the queue.

With the second type, Spot Range Queue, liquidity providers can set price brackets to make their liquidity available for sale. This is designed for low-priority trades common to high timeframe traders, who are more interested in being generally right rather than catching the precise bottom or top.

OpenSwap is also planning to release other liquidity queue types in the next few weeks. One of them, called Restricted Group Queue, is an “anti-rugpull” system, which offers protection for participants in Initial DEX Offerings (IDO) by avoiding them from total loss due to failure to list or the team running away with the money.

Sponsored

“On-chain transactions and AMMs lack the flexibility and choice of centralized exchanges,”

says Bruce Chau, CEO of OpenSwap.

“OpenSwap’s objective is to solve these inefficiencies in the DeFi ecosystems by introducing new technologies and concepts such as our liquidity queues, a way to introduce the flexibility of order books without the associated transaction costs.”

This article contains a press release from an external source. The opinions and information presented may differ from those of DailyCoin. Readers are encouraged to independently verify the details and consult with experts before acting on any information provided. Please note that our Terms and Conditions, Privacy Policy, and Risk Warning have been recently updated.