- Cypher Pattern strategy is a reversal strategy that shows market trends.

- A cypher pattern can either be bullish or bearish. This trading strategy is important to trade in the forex market accurately. ·

- The cypher trading pattern works for every market and for every time frame.

When you hear trading, what is the first thing that comes to your mind? An avenue to make profits leveraging on market volatility, right? Yes, it is! But there is more to trading than just making profits. An understanding of the different trading strategies and how to use them is essential. Otherwise, trading can land a trader in enormous losses and potential penury.

Trading deals with the exchange of currencies in the global market. There is a need to have the best trading strategy to maximize profitability in this market.

There is more to learn in trading beyond placing and closing trades during bullish and bearish movements. Traders use different patterns and strategies when trading. The prominent ones are reversal patterns, bilateral patterns, and continuation chart patterns. If you intend to trade in the crypto market, this article is what you need. It offers a guide on cypher pattern trading strategy and its uses in the cryptocurrency market.

Introduction to Cypher Pattern

What Is a Cypher Pattern? Cypher Pattern is a technical zigzag pattern introduced by Darren Oglesbee. It is a type of pattern which shows the trending movement of a market but later makes quick reversals during the day for every trading day.

A cypher pattern is both bearish and bullish. It provides harmonic patterns for successful trading. It is a projection of the unified price action pattern that is present in every market. The cypher pattern trading strategy teaches traders how to trade and draw the cypher pattern perfectly. The pattern alone is enough to provide traders with a better trading strategy.

Rules Guiding Cypher Pattern

For every potential trading pattern, there must be guidelines and laid down rules. It is also applicable to Cypher Pattern. While identifying a cypher pattern, look out for five different points. They are the X, A, B, C, and D points. The lines between each of these points are legs.

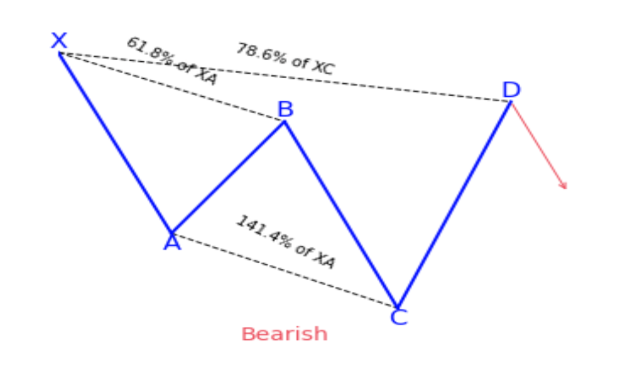

These legs are also XA, AB, BC, and CD, respectively. The pattern begins with the XA leg, while the D point represents the end of the pattern. After identifying the points and legs, follow the directives;

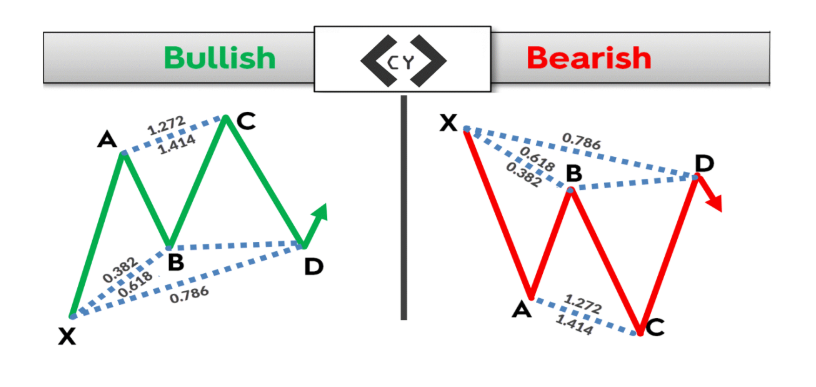

- The point B has to undergo reversal ranging between 38.2% and 61.8% of the leg XA. A minimum of 38.2 percent but not exceeding 61.8 percent.

- Point C is an extended leg and goes beyond A – but must be of a minimum value of 127.2%, but it can still exceed 113%, moving up to a maximum of 141.4%.

- The leg CD should intercept the XC at the 78.6 percent level.

- The Region of Potential Retracement of point D is a vast limit where the price is heading to, and it lies between 38.2% to 61.8%.

Any pattern that doesn’t fulfill any of these requirements is not a cypher pattern and shouldn’t be mistaken as one. You should note that there are many XABCD patterns available in the market.

Steps Involved in Cypher Pattern Trading Strategy

After exposing you to what cypher trading pattern represents in trading, you have to know how to trade the Cypher Pattern with a straightforward set of principles. This is to fulfill this article’s objective to minimize the level of risk and increase traders’ net profit.

However, before exposing you to the Cypher Patterns Trading Strategy, you need to understand how to draw and apply the trading pattern. These include indications as to when to draw and apply the pattern in a trading session.

Listed below are steps you have to follow to make your trading stand out using the cypher trading pattern strategy.

Step 1

Drawing the Cypher Patterns

- The first step is to click on the harmonic pattern indicator, which is on the right-hand side toolbar of the Trading View platform. If you are using the MT4 for trading, you will find the indicator library’s pattern indicator.

- Go ahead to identify the starting point X on the Cypher chart. This can be any crest or trough of the wave pattern. Once you locate it, look closely and follow the trend of the market.

- There must be a minimum of 4 trending high, or low points joined together to constitute the Harmonic Patterns in trading. However, each of the legs of the pattern must go in line with Cypher Patterns Trading Rules.

Step 2

When should you buy?

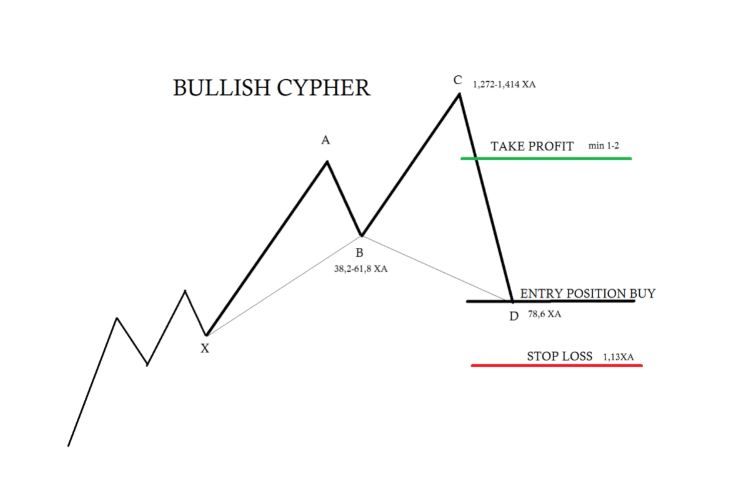

When using the Cypher Patterns, you should look out for the reversal motion of the CD leg. Once the leg reaches a point 0.786 of the XC leg, then you buy. Another preferable point to buy is the point just before the XC leg.

Step 3

Placing the Securing Stop Loss

The Protective Stop Loss should be below the X point on the trend. It is the best position that would prevent you from losing so much, should there be any break below that point.

Step 4

Taking your Profit

Always take your profit once you get to point A on the pattern. Due to the retracing characteristic of the cypher patterns, we must take our profit as early as possible because the market can reverse back at any point in time.

So as not to lose to the new swing, there must not be any delay in taking your profit. The trading pattern has a conservative target of making a profit. It would be better to take profits once you reach point A of the pattern. Yes, you heard me right. You must!

Following the above steps in trading, using cypher would maximize profits and save traders from experiencing any form of unpredictable loss.

Bearish and Bullish Cypher Patterns Rules

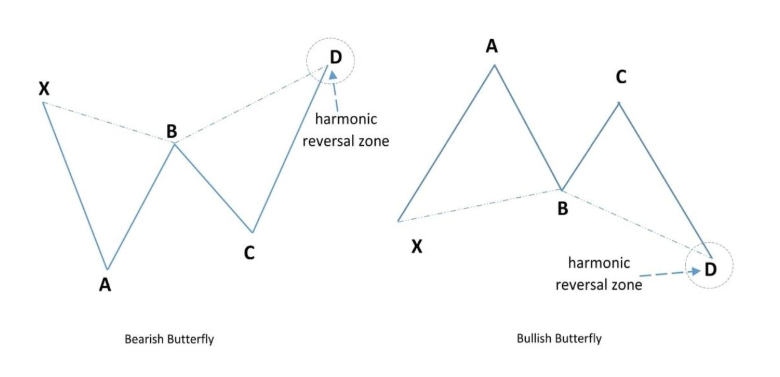

Just like the candlesticks pattern of the trading, cypher patterns can either be bullish or bearish. The cypher patterns’ principal issue is that, for the bullish cypher, the crest (low points) and the trough (high points) are trending upwards. That of the bearish move in a downward trend.

There are important points on the cypher patterns: the X, C, and D points. Point X must be the low point on the trend in a bullish cypher pattern while the C should be the high point. The X stands for the high point on a bearish cypher pattern with a low point at C.

A and C must make a low point with D lying below point X for a bearish cipher pattern. A bullish cypher pattern makes its high points at A and C and a D above point X.

The structure of the bullish cypher pattern looks closely like the letter M of the English alphabet. The bearish is just the opposite of the bearish, with an upside shape that looks like the letter W.

However, other properties apart from the structure are the same. These structures include: stop loss, entry, ratios, and profit-taking points. It doesn’t matter how the arrangement looks like and whether it is bullish or bearish, yours is to continue with your trading and hit a jackpot.

Cypher Pattern strategy success rate

No strategy in this world would offer 100% outcome, even those outside trading. On average, you are subjected to a success rate of 80% while using the Harmonic trend of the Cypher Patterns.

However, many successful traders stated that the minimum success rate you could have to be sure that the strategy is in your interest is 40%. Anything below this denotes an inefficient result of the strategy.

If we should place this trading strategy on the Risk-Gain ratio and a 40% success rate, we could see that this strategy possesses a very great efficiency. Be careful not to misuse the patterns so as not to incur losses while trading.

Conclusion

Cypher Patterns are the most exciting types of harmonic (XABCD) patterns. With it comes to the management of risk during trades, these patterns are helpful. This is due to the high success rate that comes with it. You can also reduce losses using this pattern.

Although the Cypher Patterns has a larger success rate than any other harmonic pattern, it is not common on the trading chart.

Testimonies from potential Forex Traders confirmed that cypher patterns trading strategy is very reliable among other harmonic patterns.

As a trader who hopes to stand out and make real profits in the forex market, you should study more on cypher pattern trading strategy. Track the market indicators and how to use this strategy effectively.