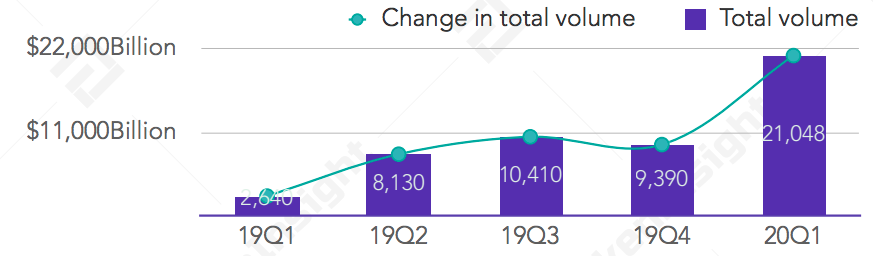

The total volume of Q1 cryptocurrency derivatives in 2020 exceeded $2 trillion, an increase of 314% from 2019 fourth quarters’ average.

The recent study by blockchain data and research company TokenInsight indicates that the total cryptocurrency futures contract trading volume reached more than $2.1 trillion in the first quarter of 2020.

Except for a slight decline in 2019 Q4, the trading volume of cryptocurrency futures has grown steadily during the year, however the total market turnover is approximately 8 times larger compared with the first quarter od 2019.

Comparison of cryptocurrency futures trading volume between 2020 Q1 and 2019 Q4

As says the report, 12 derivatives exchanges were included in analysis. The names like BitMEX, OKEx, Huobi DM, Binance Futures, Deribit, Bitget, Binance JEX, FTX, Gate.io, BFX.NU, BitZ, and KuMEX came together with some emerging derivatives trading platforms.

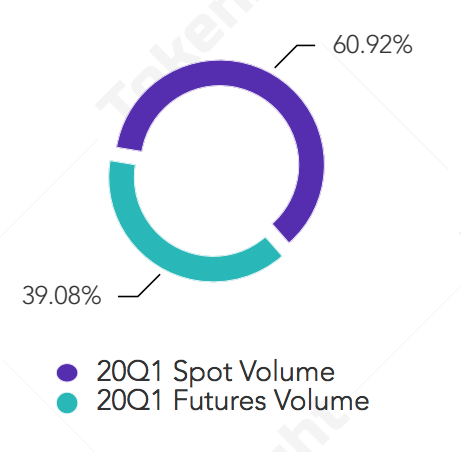

Futures trading vs spot trading

The TokenInsight’s analytics discovered that the correlation coefficient between futures trading volume and the spot trading volume fell to 0.31 from the 0.76 of the 2019 first quarter. According to researchers, the fact indicates that the futures market participants may have been relatively independent from the spot market.

Sponsored

The spot is contract of buying or selling digital currency on the spot date, which is normally two business days after the trade date. Meanwhile, futures are the agreement to buy or sell something at a predetermined price at a specified time in the future.

Sponsored

The report also shows that the cryptocurrency futures turnover in 2019 was about 20% of the spot. While the total turnover of cryptocurrency futures has reached more than 33% of the spot during 2020 Q1, the analytics expect, that the futures trading volume for 2020 will be more than doubled the spot market.

Cryptocurrency futures volume and spot volume

According to the data, three major asset contracts of crypto futures accounted for more than 90% of the total market turnover in the first quarter of 2020. Bitcoin (BTC) futures remain the most popular and their futures contract turnover accounted for 78%.

The TokenInsight report claims, that according to the data of the first quarter of 2020, there were 7 exchanges with total futures turnover exceeding $100 billion. These are Huobi DM, OKEx, BitMEX, Binance Futures, Bitget, ZGB and Bybit. Meanwhile, Huobi DM and OKEx are in the first positions with volumes over $400 billion.