- Bitcoin Diamond (BCH) is the hard fork of Bitcoin, created for faster and cheaper transactions.

- With a $114 million market cap, it still is among Top 100 digital currencies.

- Bitcoin Diamond has high supply, low price and low liquidity.

It goes without saying that diamonds, just like gold, are the safe-haven assets. From a crypto perspective though, let’s have a look which is better: a digital diamond or a digital gold?

The digital diamond is Bitcoin Diamond (BCD), to be precise. The coin that forked from Bitcoin just a few years ago carries the ambitious name, however, ranks #89 by the market capitalization. Nevertheless, it helps to solve some fundamental shortages of Bitcoin and still interests cryptocurrency users.

Despite the fact, the most important question for the crypto community remains the same: is it a good investment?

What is Bitcoin Diamond (BCD)?

In general, Bitcoin Diamond (BCD) is a digital currency that supports faster transactions and lower transaction fees. Created back in 2017, Bitcoin Diamond is the fork of Bitcoin.

Sponsored

This means that the BCD has formed as a critical Bitcoin’s protocol upgrade when Bitcoin Diamond developers modified the Bitcoin source code to meet their requirements: faster transactions, lower transaction fees and the entrance threshold.

The fork happened on block 495.866 at the end of November 2017. The year is famous for the cryptocurrency hype and the meteoric Bitcoin price rally, which ended with the all-time high of $19.783 in mid-December 2017.

The time was full of emerging Bitcoin hard forks then. The majority of them were simply scam forks, created to exploit Bitcoin’s name and to profit from its hype. While lots of them disappeared quickly, some BTC hard forks of the time survived up till today. Bitcoin Diamond together with Bitcoin Cash is one of them.

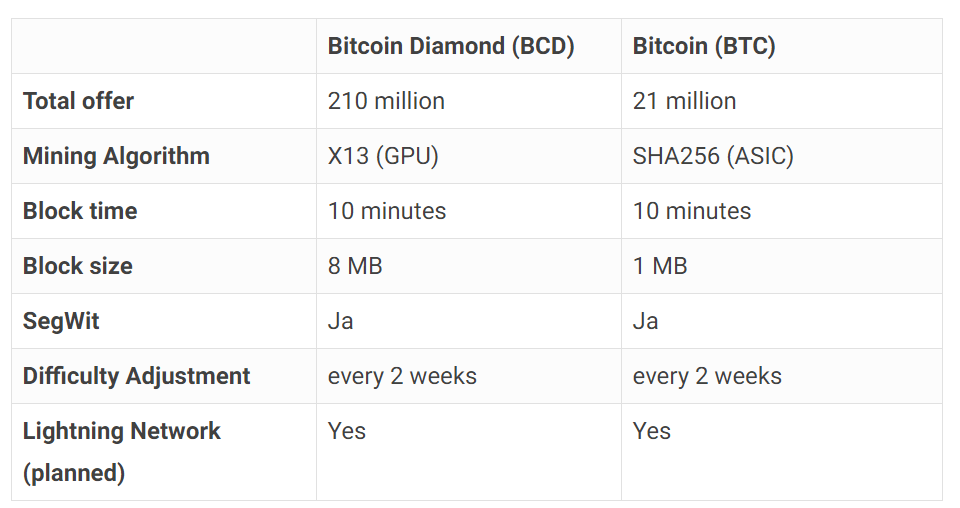

The difference from Bitcoin

The idea that inspired the launch of Bitcoin Diamond laid in the protocol of Bitcoin. When the amount of Bitcoin users increased monumentally in 2017, the network became extremely congested. Each Bitcoin block, mined every 10 minutes, had limited size and held only 1MB of transactions back then.

Sponsored

However, the demand far exceeded these limits, allowing BTC miners to confirm transactions with much higher fees. The price of BTC transactions increased and made the network too expensive for small-scale payments. Moreover, they became uncomfortably slow.

Bitcoin Diamond, meanwhile, came with the upgraded technology and up to 8 times higher block size, which allowed faster and consequently cheaper transactions. The hard fork even adopted the Lightning Network as a second layer payment protocol, that does not record transactions and thus speeds up the process. Smaller transactions became more affordable and available.

Furthermore, BCD became much easier to mine for a wider audience. The hard fork used an X13 mining algorithm that supported crypto mining with graphic processors (GPU). The protocol excluded ASIC, expensive and powerful mining hardware, mainly used together with Bitcoin’s mining algorithm SHA-256.

For implementing another goal – to lower the entry threshold for the new users, Bitcoin Diamond developers offered an unusually high 1:10 coin distribution rate for the protocol users. This means that Bitcoin owners who held BTC at the time of the network’s split got 10 times more of free Bitcoin Diamonds (BTC) equal to 1 Bitcoin.

Accordingly, the total supply of newly launched BCD came in ten-fold higher numbers compared to BTC. The total supply of Bitcoin Diamond reached 210 million BCD coins. Having in mind, that the low supply allows the asset price growth, the high total supply, on the contrary, brought the asset’s price down, making it more affordable than Bitcoin.

The price history of BCD

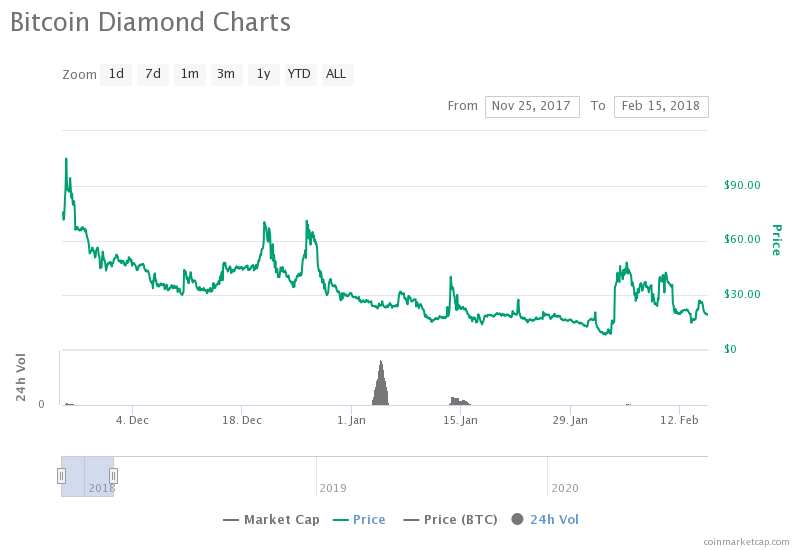

Right after the hard fork, Bitcoin Diamond peaked up to $99.37, which was the asset’s highest price of all-time, according to CoinMarketCap. The price, however, lost more than two-thirds of its value in the upcoming weeks and by falling down to $30.35 on December 10.

Following the legendary crypto bull run of late 2017, the asset’s price tried to shoot up twice again during the same week at the end of December. It tested the mark of $70, however, lacked support and continued to lose its value until February, when it reached the lows of $8.42.

To be precise, all this happened during the first days of crypto winter, that started at the beginning of 2018 and simultaneously affected hundreds of digital coins, causing the massive collapse and the explosion of a crypto bubble.

Despite the fact of the falling markets, Bitcoin Diamond tried to regain its value and crossed the $40 mark twice in February 2018. A bull run a month before the planned Lightning Network and BCD walled launch, however, wasn’t sustainable. BCD fell drastically during the last days of February and cost $6.44 on March 1.

The asset never again reached the previous highs. Within a year from its launch, Bitcoin Diamond has lost almost all of its value and was worth $1.5 at the end of November 2018.

The following year brought a further price drop. The highly volatile BCD swung to the record lows of $0.26 on March 13, the day when all global markets crashed down due to COVID-19 pandemic.

Bitcoin Diamond price increased by 134% since then and is $0.61 at the time of writing. With the current market capitalization of over $114 million, BCD is still among the Top 100 digital currencies.

Is BCD a good investment?

Bitcoin Diamond aims to be a better Bitcoin, but it is not the only hard fork offering “better” features. A competitor Bitcoin Cash (BCH) also allows faster and cheaper transactions. Moreover, it ranks 83 positions higher than Bitcoin Diamond by market capitalization and had almost 10 times bigger trading volume than BCD.

BCD presents itself as a cheaper and faster alternative for global purchases compared to fiat currencies and credit cards. According to the network’s Twitter posts, BCD developers are constantly looking for more companies to support Bitcoin Diamond and even hope for its global adoption in the long term. Meanwhile, the reality is that only a few digital asset exchanges support direct BCD to fiat trading.

The network, however, went through it’s third halving this August, meaning that the block reward for Bitcoin Diamond miners was cut in half from 125 to 62.5 BCD. Historically the reduced number of newly minted coins impacts the price of the asset and leads to the growth of the value.

Despite the halving though, Bitcoin Diamond lacks more fundamentals to predict its price future movements. The network has no important updates announced in the upcoming roadmap, moreover, it doesn’t seem to be upgraded since 2019.

With all the details in mind, the cryptocurrency diamond doesn’t seem to fit the definition of a natural one. Bitcoin Diamond is not scarce, it is cheap and has low liquidity – far beyond the criteria of a perfect investment.