- Cryptocurrencies have made thousands of millionaires

- Trading cryptos have made more millionaires than early investments.

- How much do you need to become a crypto millionaire in 2021?

- Three things you need to avoid on your journey to becoming a crypto millionaire

After Bitcoin’s stellar run in the last two months, our attention has turned once again to the profitability of the crypto market. How much profit can one make from crypto markets?

You probably have heard the testimonies of people who have become millionaires by simply investing in Bitcoin. However, many of them invested in Bitcoin in the first few years after its launch.

Sponsored

Twelve years after the launch of cryptocurrencies, how realistic is it to become a millionaire from crypto? Let’s take a look

5 Ways People Have Become Crypto Millionaires?

While many people are familiar with people like Charlie Shrem and Winklevoss twins who made it big by investing in Bitcoin when it sold for next to nothing, there are other ways people have crypto become millionaires.

1. Early Investment in a Digital Asset

This is perhaps the most popular way people have become crypto millionaires. Former United States marine, Jered Kenna is a great example. Jered invested in Bitcoin during its infancy when 1BTC was around $0.20, and he reportedly bought thousands of BTC.

Sponsored

There are hundreds of others who share a similar story to that of Jered Kenna. However, is it still possible to become a millionaire by investing $10,000 in Bitcoin in 2021? The simple answer is no.

Early Bitcoin Investor Jered Kenna

While Bitcoin is past its early days where you can get 1000x your investment, there are other cryptocurrencies at this stage.

Caution: On the account of the latest crypto market bull run, expect to see a plethora of cryptocurrencies promising 1,000x returns before the next quarter of the year. Any crypto that promises returns first (without any real-world project as a back), avoid it like the black plague.

Jumping on the next crypto remotely looks promising, but isn’t a guaranteed way of becoming a millionaire. Jared and the hundred others won’t be millionaires today if Bitcoin hadn’t survived the test of time.

There are currently over 8,200 cryptos on CoinMarketCap. For a project to fetch you a million, it must be future proof. Although it is getting increasingly difficult to find such projects because of the growing number of cryptos being launched, the possibility still exists.

2.Buy and Hold a Digital Asset

The next best method is to buy a digital asset to hold it over a long period of time (hodling). If you had bought Bitcoin in 2015 when it traded at around $200, you would currently be enjoying 180x your initial investment.

A great example is 21-year old Erik Finman. At the age of 12 in 2011, he received a gift of $1,000 from his grandmother. Instead of saving the money for college, Finman bought $1,000 worth of bitcoin when it was valued at about $10 – $12. He reportedly owned 446 BTC and was worth $4.5 million as of August 2019.

Teen Bitcoin millionaire, Erik Finman

An investment of $1,000 would be $180,000 today, $5,000 would be $900,000, and $10,000 would have been $1.8 million. In six years, Bitcoin would have easily made almost anyone a millionaire, and Bitcoin is not the only digital asset.

During the same period, Ethereum would have yielded a x1,480 ROI and Litecoin would have yielded a x71 ROI. The same holds for many other digital assets. The key to making a 1000x ROI, or more, in crypto, is holding the asset for longer than usual.

If you miss out on early investment, the next best thing is buying and hodling. For this to be the case, the crypto you decide to put your money behind must be future-proof, not a pump and dump scheme, more on that later.

3. Trading Cryptos

Trading cryptos have made more millionaires than other ways. Trading cryptocurrency is similar to trading currency on the foreign exchange. To put it simply, you buy a cryptocurrency at a low (or high price) and hold it until you can sell at a higher (or lower) price.

It’s worth noting that there isn’t a single style of trading cryptocurrency guaranteed to make one a millionaire. Before getting off to trade, you may need to get knowledge on how to trade and the styles of trading.

- Scalping: the goal of scalping is to make constant profits from very quick trades. You might make a trade every few minutes. It requires good risk management and good market reading skills. Although the profits from scalping can be small, they add up very quickly.

- Day trading: is very similar to scalping, but here, trades are held over the course of the day.

- Range trading: like fiat, cryptos create ranges of uptrends, consolidation, retracements, or downtrends. A range trader identifies these ranges and trades around only one at a time.

- Inter-day trading: this style of trading allows a trader to hold positions over more than one day to maximize his profits.

- Swing trading: is the advanced form of range trading. The trader identifies a low or high and holds his position until the asset hits the next high or low. A swing trade may take days, weeks to be complete.

- Position trading: is the longest form of trading and is very similar to investing. A trader takes a position and holds it for weeks, months, or even years until it gets to his desired price.

Some trading styles are more likely to fit a person’s tastes, tolerances, and goals than others. Your objective would be to find a trading style that works for you and sticking to your trading rules.

4. Crypto Mining

Mining was one of the first-ever ways to obtain Bitcoin. Many other digital assets are also mined. Mining is the process by which powerful computers solve complex mathematical problems and are rewarded with Bitcoin or other altcoins.

11 years ago, mining wasn’t as complicated, then miners were able to mine thousands of BTC using just their home computers. Now, we live in different times. To mine in today’s BTC scene, you’ll need top-tier specialized equipment that costs a few thousand bucks.

Because of the situation now, mining is a slow and hard process because of the increasing competition and reducing profit. To stand a chance, you may need to join Bitcoin mining pools or mining clouds.

A Bitcoin mining pool is a collaborative group of miners combining their different pieces of equipment. A mining cloud service is similar, however, they use the cloud to connect their computing power.

5. Cryptocurrency Funds

If you want to invest in cryptocurrency, but you don’t have the stomach for watching 24-hour price fluctuations, you can invest in publicly traded funds that purchase crypto. An example is the world’s largest hedge fund Grayscale Bitcoin Investment Trust (symbol GBTC).

The drawback is that these funds often come with lower returns than trading crypto on your own. Grayscale has experienced a meteoric 60 percent increase in share price since November 2019. However, one can make more in the same period.

How much do You Need to Become a Crypto Millionaire?

So, how much do you need to become a crypto millionaire in the next 12 months?

1. Can You Become a Crypto Millionaire with $10,000?

If you want to venture into the crypto market with $10,000, you have more options available. Also, the chances are much higher. With $10,000, you would need a 100x ROI in 2021 to become a millionaire. Is that achievable in 2021?

Yes, if you manage to find the right cryptocurrency. For example, Verge managed an insane 2,000x growth in 2017 when Ethereum achieved a 165x ROI. XRP and NEM both did a combined 120x in 2019. These are all real crypto projects, not pump and dump schemes.

With $10,000, you can also venture into mining of cryptos or even diversify your crypto portfolio and wait for them to explode. If you decide to go down the path of trading with a capital of $10,000 also means that you have more to put on the table for more profits.

2. Can You Become a Crypto Millionaire with $5,000?

Although half the price, it doesn’t take anything away from the possibility of making the $1 million. Deciding to go down the path of crypto mining with $5,000 may not be as profitable as advertised.

Throwing your money into a crypto fund will also not make you a millionaire in the next year. This leaves you with investing and trading.

The rules for investing and crypto trading haven’t changed either. Before investing, do your research, and before trading cryptos, study and understand the market.

3. Can You Become a Crypto Millionaire with $1,000?

The probability of turning $1,000 into $1 million is very low, it’s impossible. Investing and trading are the two options available.

However, to find an opportunity that will offer a 1000x ROI, you may need to do a lot of research. In fact, with the growing number of cryptos, we recommend trading as a better option.

To trade with $1,000, you would need more discipline and skill than the average trader. Set feasible goals and stick to them. Even if you don’t end the year a millionaire, you would close with considerable profits.

In a nutshell, more important than how much you have to start investing in cryptocurrencies is how well you manage your funds. Your approach to investing is also an important tool in becoming a millionaire.

Things to Avoid On Your Journey to Becoming a Crypto Millionaire?

The journey to becoming a crypto millionaire isn’t as problem-free as many would have you believe. In fact, the chances of losing your entire investment are greater than that of you becoming a millionaire.

To reduce the risks of these pitfalls, we have compiled a list of things you should avoid in the crypto space. While the list is not exhaustive, it will give you a clear idea of what to look out for before investing.

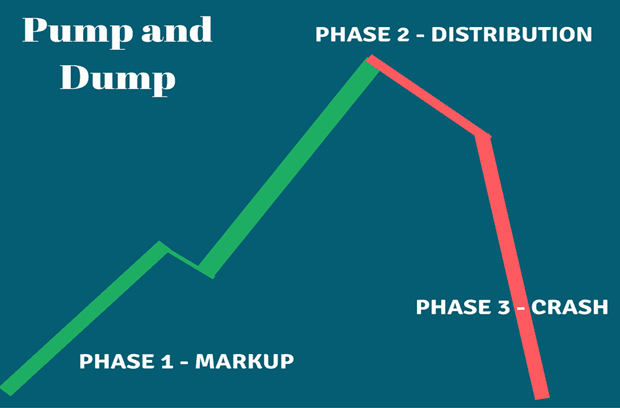

1. Pump and Dump Schemes

Crypto projects that offer no real value are often referred to as pump and dump schemes. These projects put a lot of hype around the price and future of the asset (without any real use case).

Investors jump in through these misleading adverts, the price of the project spikes, and fraudsters behind the project sell off their holdings. The price hits rock bottom, leaving investors with valueless digital assets.

This is a very common form of fraud in the crypto industry. An example is Gemcoin, which is claimed to be backed by real mines around the world. Founder Steve Chen was sentenced to 10 years in federal prison for defrauding 70,000 people of $147 million.

Before making any form of investment, make sure to dedicate time to research any project you want to invest in. Pump and dump schemes are easy to spot, they have no real-world use case and also have no feasible future roadmap.

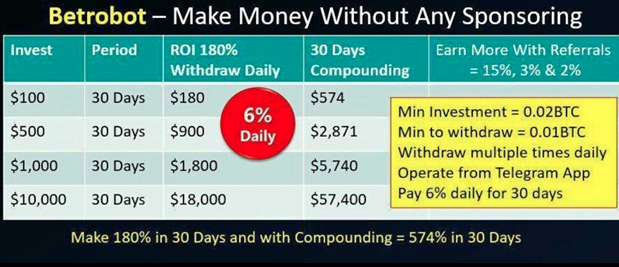

2. Platforms Promising Impossible Weekly ROI

If you have been on social media recently, the chances are high that you have come across a link to a Telegram group or a specific subreddit on Reddit.com promising you 50 percent ROI one week after investment.

For the sake of your heart, avoid such platforms, run away from them like you would from a burning building. They are scams. One popular project is Bitconnect which was responsible for defrauding people of $2.6 billion worldwide.

3. Fear of Missing Out and Over-Trading

These are the two easiest ways to lose all your crypto holdings. Some investors, mostly beginners, want to make 20 trades a day. In reality, there may not be 20 good trading opportunities a day. Trading too much leads to poor decision making.

Another way to lose money is Fear of Mission Out or FOMO, when investors hear of a price spike in a digital asset, they quickly jump on the bandwagon to make their own share of profit; a recipe for disaster.

Chasing trades and investment opportunities never end well. Before investing, do a detailed research on the project. When trading, we recommend that you create a checklist of rules and always stick to it.

Conclusion

There is still room in the crypto space for many more people to build wealth in 2021 and beyond. To join the list of millionaires made by cryptos, you can follow the model set by other individuals; buy low, hold, sell high, reinvest, and trade.

With the growing number of cryptos (and scam projects alike), becoming rich now involves more work in identifying a future-proof project that works for you, patience, and time. All the best on your journey to making seven digits from digital assets.